Asset Management In Odoo

Business organizations have to invest in different assets to run a successful venture over a long period. Some tools like machinery, cars, etc are not consumed at once but used over a certain period of time. Maintaining assets and having their proper record helps the organization monitor assets to have an insight on loss/gain involved in each asset. Asset Management can be described as a streamlined process of deploying, maintaining records of assets from their initial purchase to their salvage value which is depreciated amount of asset over a period of time. To accurately represent proper value in the balance sheet, expenses of assets are represented periodically over those years. Asset Management In Odoo allows the creation of asset models & keeps track of depreciation by creating entries that are periodically posted.

Depreciation Methods Used:

a) Linear Depreciation Method:

The linear depreciation method is one of the simplest and most widely used methods to calculate the depreciation for fixed assets. The allowance is recorded in equal parts for every interval for the entire duration of assets lifecycle.

b) Degressive Depreciation Method:

In this method depreciating amount is based on a degressive factor which is multiplied by amount.

c)Accelerated Degressive Method:

Combination of linear & degressive depreciation, first depreciation is calculated in the same way as degressive multiplying with a factor & follow linear depreciation method once it reaches the linear value

Activate Asset Management:-

Accounting >Configuration >Settings >Automated Entries >Asset management

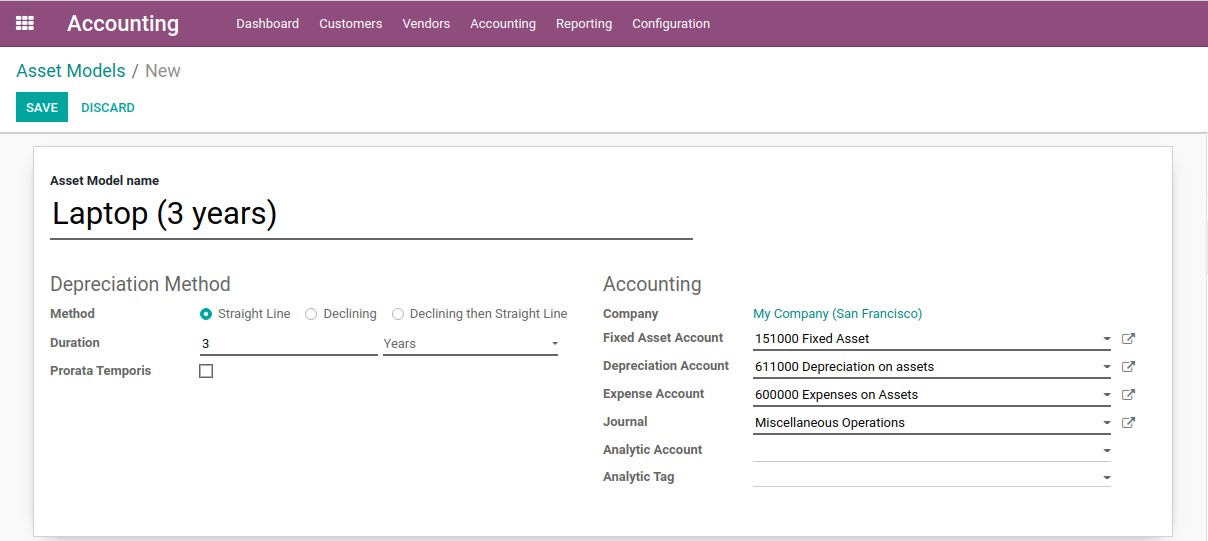

Asset Model Creation:

Accounting -> Configuration -> Management -> Asset Model -> Create

a)Asset Model Name: Add Asset Model Name according to asset name for ease of use.

b) Method: Select Method of Depreciation under Depreciation Method.

c)Duration: Add duration according to a number of depreciations. We can select those in terms of months or years as per requirement.

d) Prorata Temporis: If we tick the boolean field, depreciation starts from the date of asset creation.

e) Accounting: Add all accounting details including Fixed Asset Account, Depreciation Account, Expense Account, and Journal. We can add Analytic Account & Analytic Tag if required.

Mandatory Fields can be easily identified by bold lines. Optional fields can be used if necessary.

After adding all details; an Asset model is created

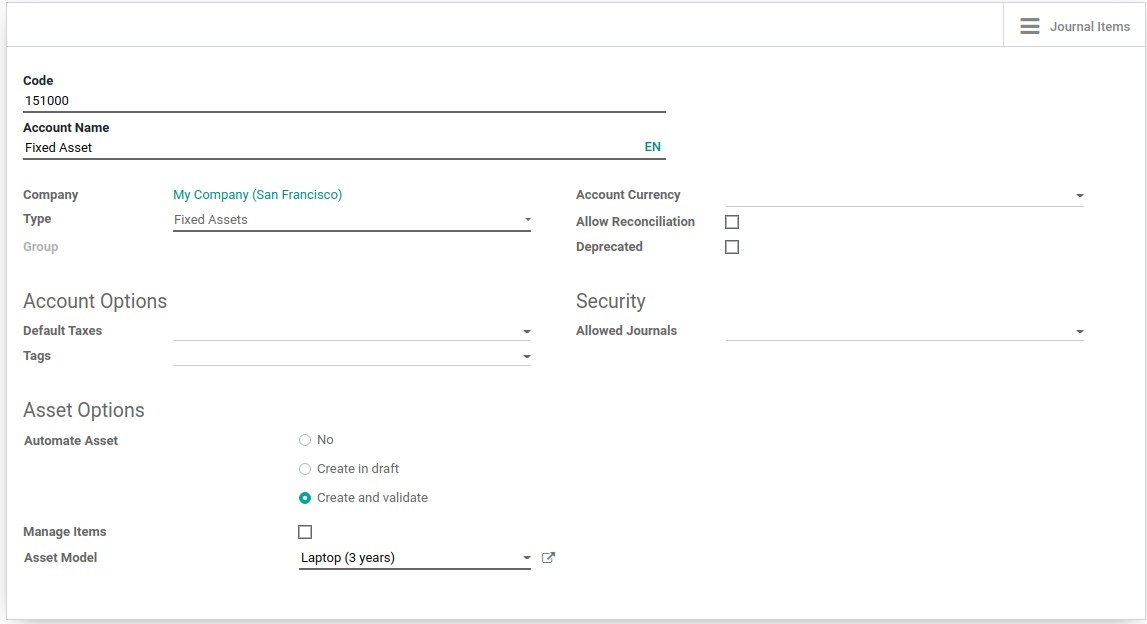

Assign model to asset account in Chart Of Accounts:

Accounting -> Configuration ->Chart of Accounts

After adding all details, save it.

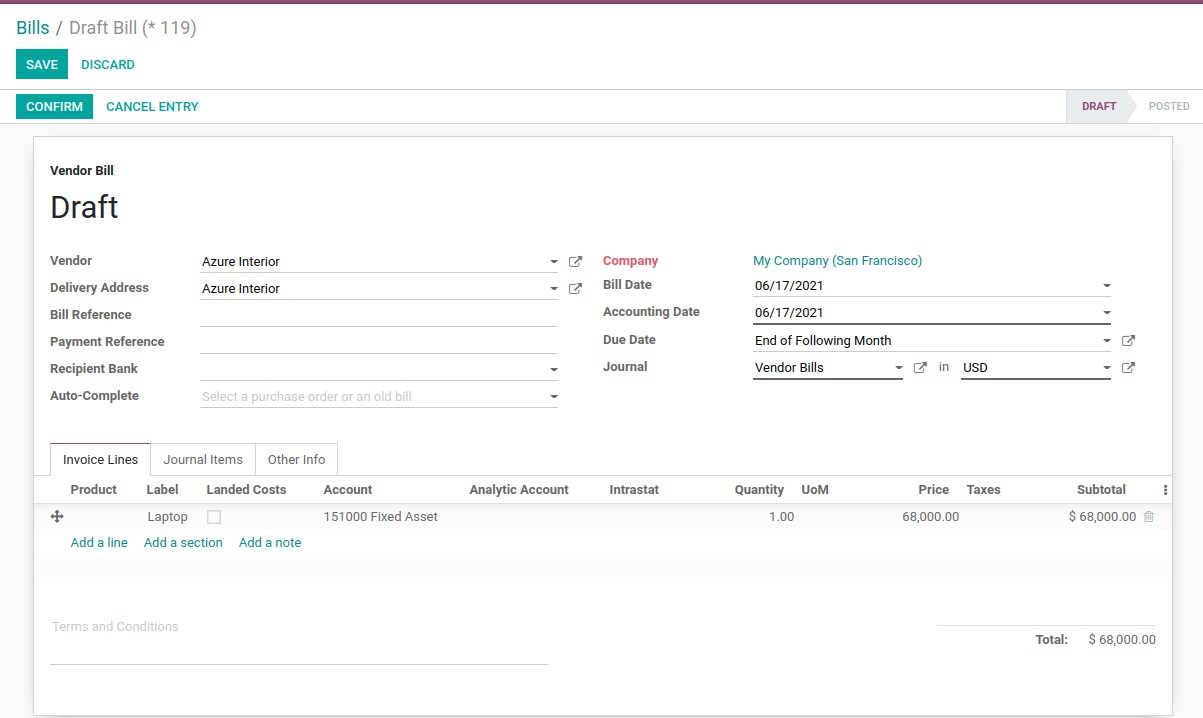

Asset Procurement (Purchase):

We have to convert Product to an asset once procured. We have to create an invoice & add asset account for the same.

Add detail of asset including label, account, quantity, price and after confirming all details are proper to confirm the bill.

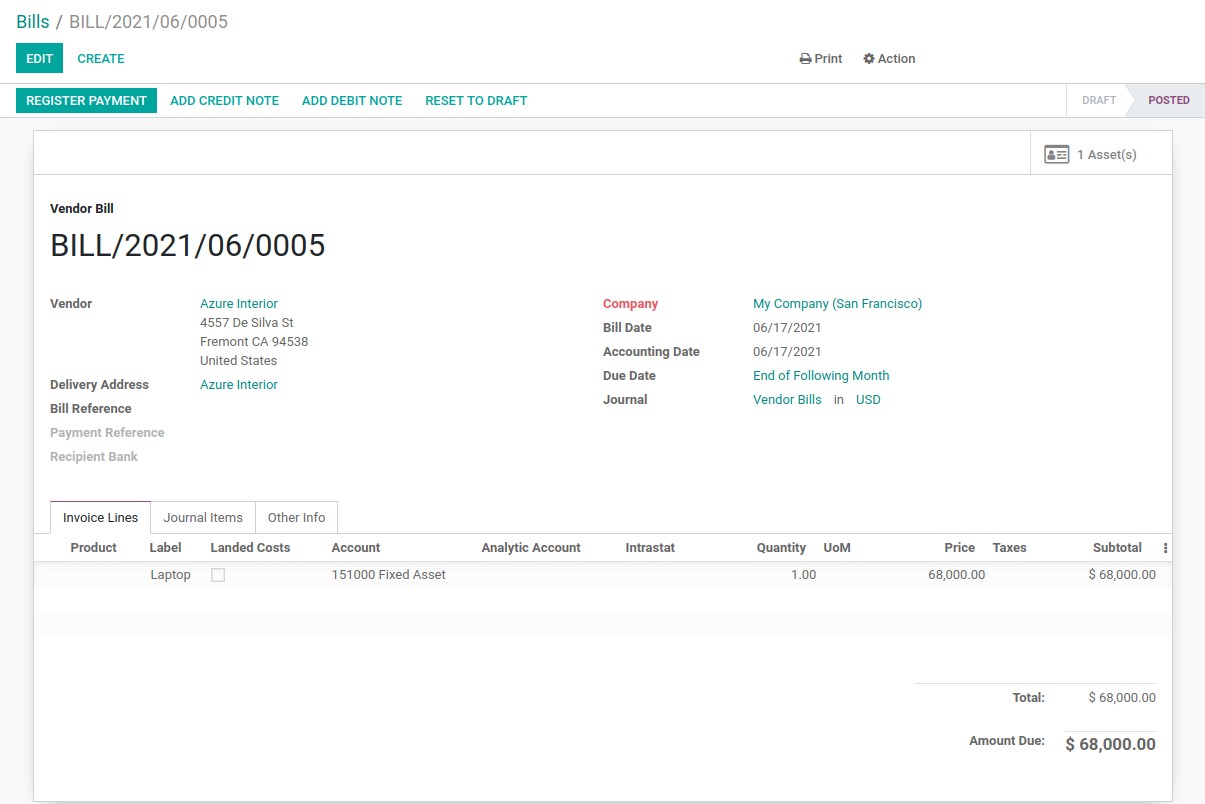

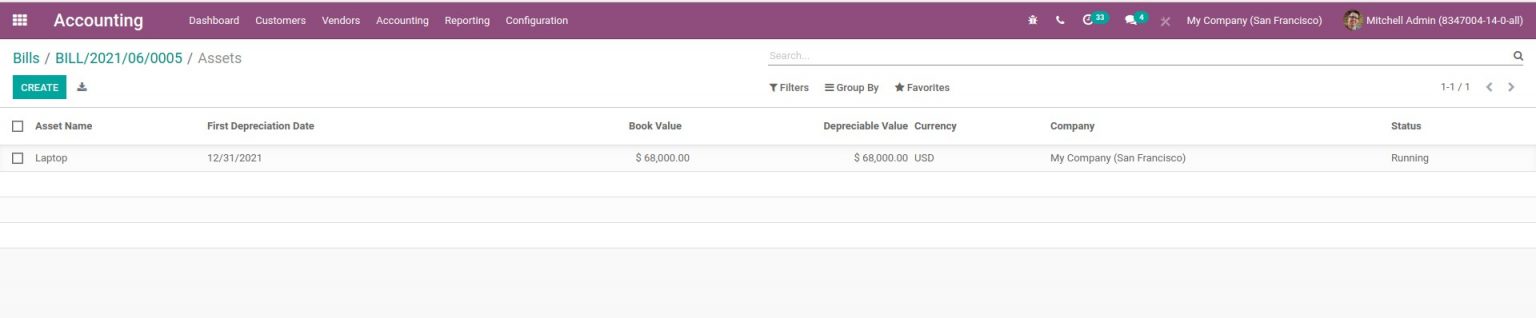

Once confirmed by clicking on Confirm Button, we can see Assets details through smart button.

After Asset is created we can see details including status, date, value etc. After opening that we can see all entries of depreciation.

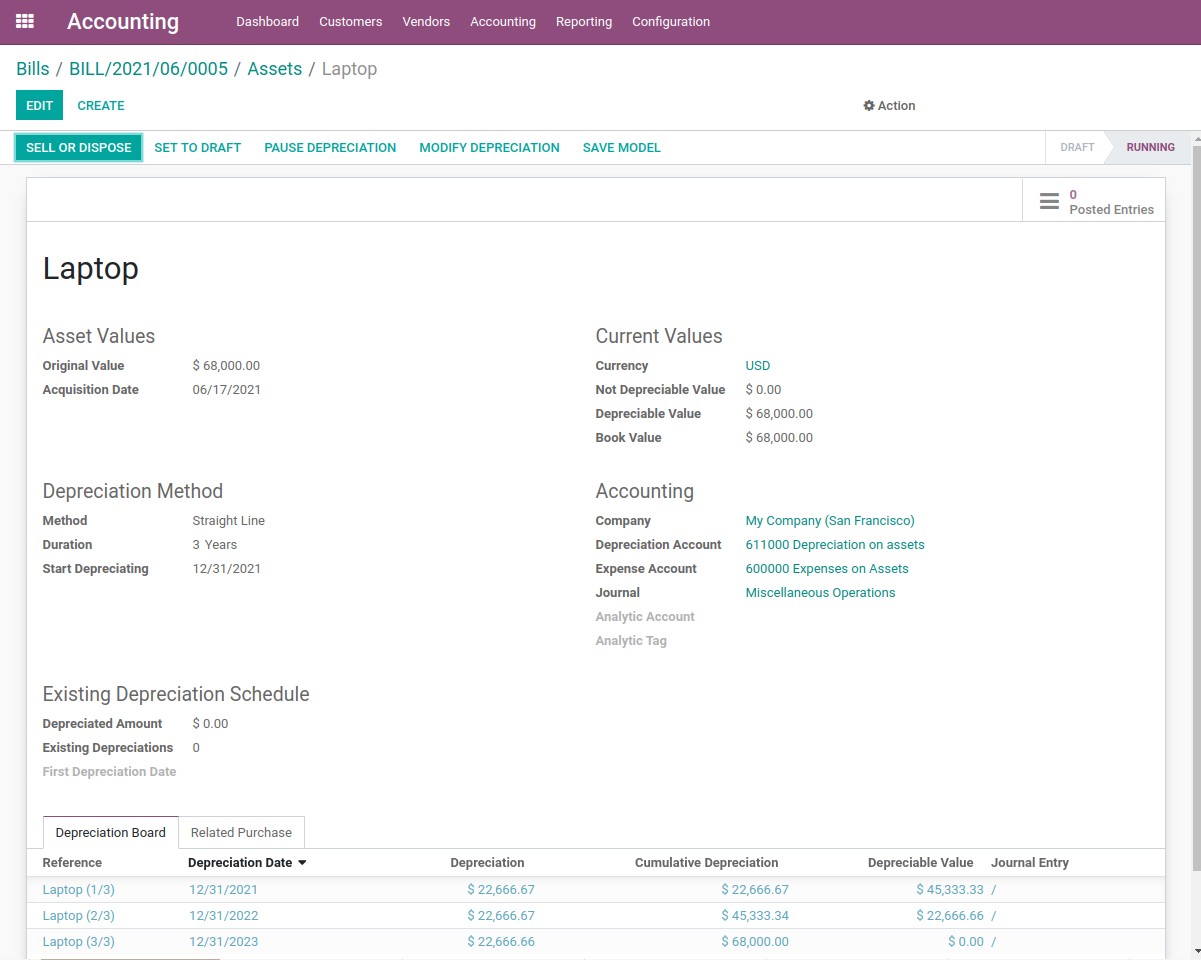

Here we can see details of Asset Value, Depreciation Method, Accounting & other details. Under Depreciation Board we can depreciation details of all entries for total depreciation duration .

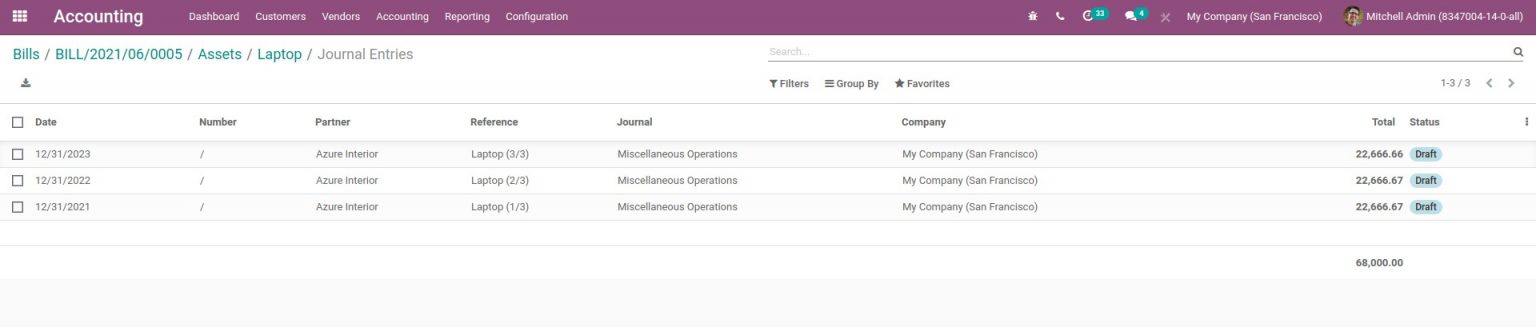

We can see entries that are posted by clicking on the smart tab of Posted Entries.

System automatically post entries on corresponding dates as decided. We can also see status of entries at the right side.

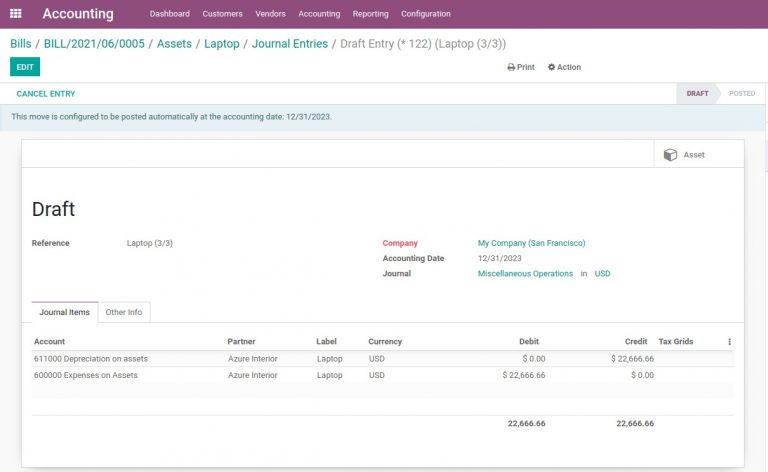

In the case where we have configured to entries to be posted automatically according to determined date. We can see message”This move is configured to be posted automatically at the accounting date: 12/31/2023″.

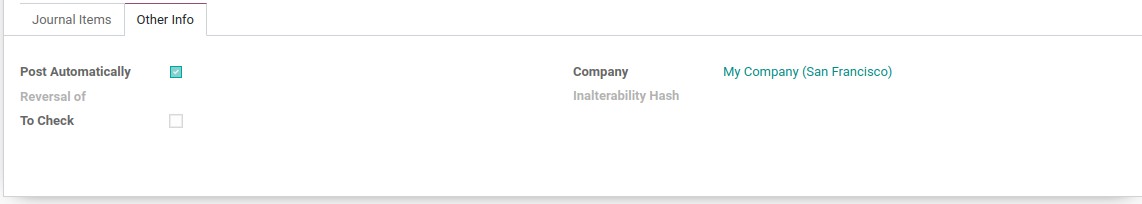

In the Other Info we can see boolean field of Post Automatically, unticking which we can post entries manually. Once posted; entries will be reflected in Profit & Loss account.

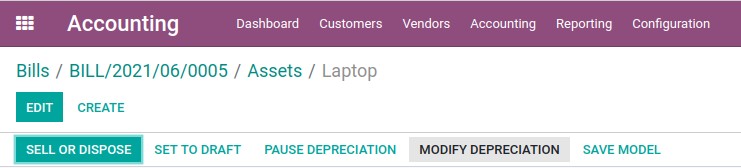

We are having different smart buttons using which we can Sell Or Dispose, Modify Depreciation etc easily.

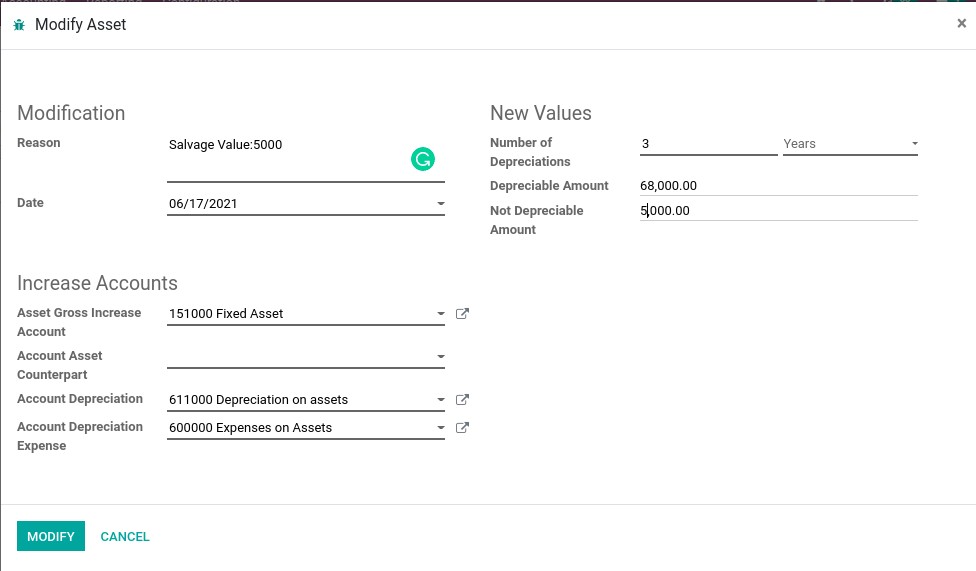

By clicking on Modify Depreciation, we can change Salvage value & also add reason for change.

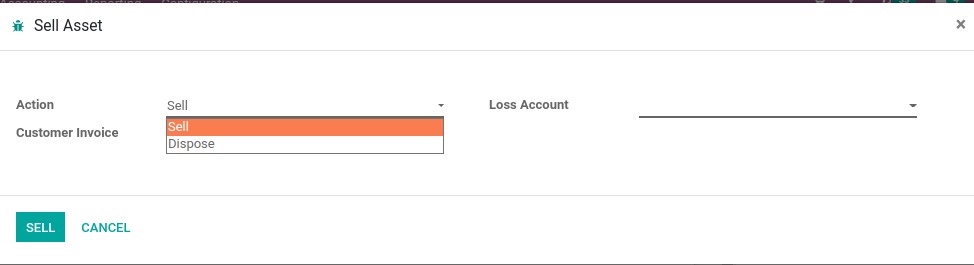

We can Sell or Dispose assets and maintain the detail of records by clicking on the Sell or Dispose button and select accordingly in action.

For any further queries or if you’re looking for a reliable Odoo implementation Partner do contact us on our website www.infintor.com