Managing Intra-Community Trade using Intrastat in Odoo 16

Intrastat is a system used in the European Union (EU) to collect and disseminate statistical information on the trade of goods between EU member states. The primary purpose of Intrastat is to provide data that helps governments, businesses, and policymakers monitor and analyze the movement of goods within the EU’s single market.

Here are some key points about Intrastat:

=> Data Collection: Intrastat requires businesses that engage in cross-border trade within the EU to report detailed information about their intra-EU transactions. This data includes the value of goods, quantity, commodity codes, and the countries involved in the trade.

=> Thresholds: Not all businesses are required to submit Intrastat declarations. Each EU member state sets thresholds for Intrastat reporting. When a business’s trade with other EU countries exceeds these thresholds, they are obligated to provide Intrastat declarations. The specific thresholds can vary from one member state to another.

=> Frequency: Intrastat declarations typically need to be submitted on a monthly or quarterly basis, depending on the volume of a business’s cross-border trade. In some cases, businesses with very low trade volumes may only need to report annually.

=> Commodity Codes: Intrastat declarations use a standardized system of commodity codes (known as the Combined Nomenclature) to classify the goods being traded. This system allows for the classification of goods in a uniform way, making it easier to analyze trade patterns and compile statistics.

=> Statistical Purposes: The data collected through Intrastat is primarily used for statistical purposes. It helps governments and other stakeholders track the flow of goods between EU member states, identify trends, and make informed decisions regarding trade policies.

=> Customs vs. Intrastat: Intrastat should not be confused with customs declarations. Customs declarations are submitted when goods cross national borders, while Intrastat is focused on collecting data for statistical analysis. Both may be required for businesses involved in international trade within the EU.

=> Penalties: Failing to comply with Intrastat reporting requirements can result in penalties and fines imposed by the relevant national authorities.

Let’s see how we can facilitate the feature of Intrastat in Odoo 16 through the Accounting module.

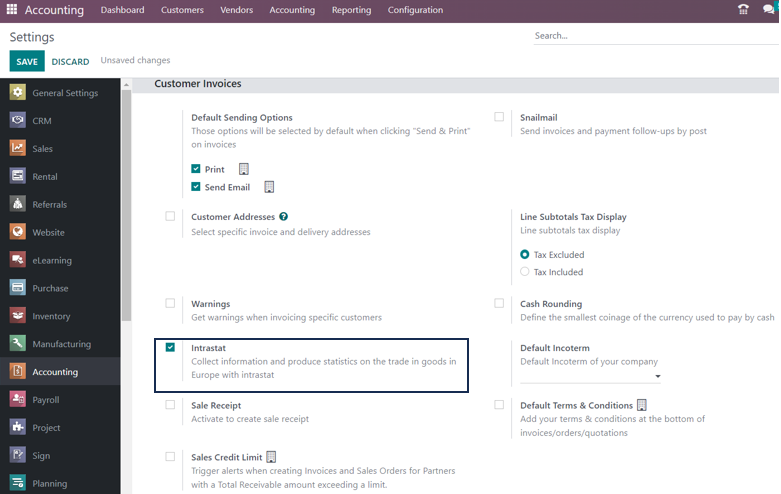

Accounting Application => Configuration menu => Settings => Customer Invoices section => Intrastat => Save

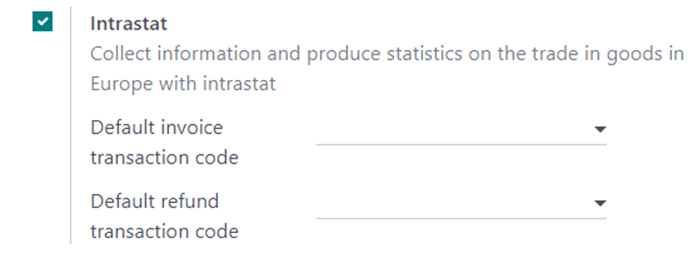

On enabling the Intrastat feature, we have the option to select Default Invoice Transaction Code and Default Refund Transaction Code.

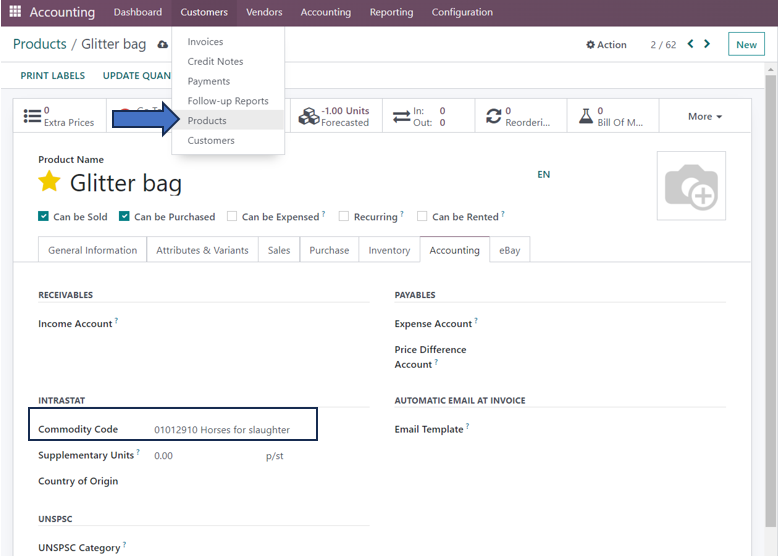

This automatically generates and displays specific codes for each invoice and refund created. Now, that we have set default transaction codes. But we need to also specify the ‘Commodity Code’ for each of the products at the time of product configuration which can be done by selecting the ‘Products’ option in the ‘Customers’ tab of the ‘Accounting’ module.

Go to the ‘Accounting’ tab of the product configuration page of the selected product in which we have to mention its commodity code. A commodity code, often referred to as a Harmonized System (HS) code or a tariff code, is a standardized classification code used to identify and categorize goods for international trade and customs purposes. These codes are used to simplify and harmonize the process of classifying and identifying products as they cross international borders and enter various customs territories.

Along with the Commodity code, we can also specify other details such as Supplementary units and Country of Origin.

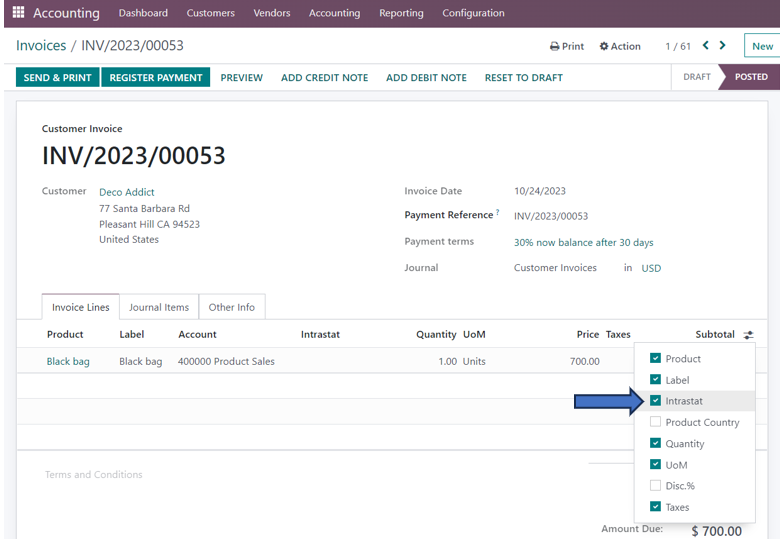

Other specifications need to be done in the order lines that we create using Intrastat. Apart from using default transaction codes that we have set up in the settings, these order lines can be specified in individual invoices and bills that are created.

On selecting the ‘Intrastat’ option in the additional fields under the ‘Invoice Lines’, a new column of ‘Intrastat’ is visible where we can add a transaction code for that particular invoice. In the ‘Other Info’ tab of the customer invoice, we can also mention the partner county in the ‘Intrastat Country’ field. When we mention the ‘Intrastat Country’, the ‘Intrastat Transport Mode’ field appears just below it where we need to mention the mode of transportation of goods in the invoice created.

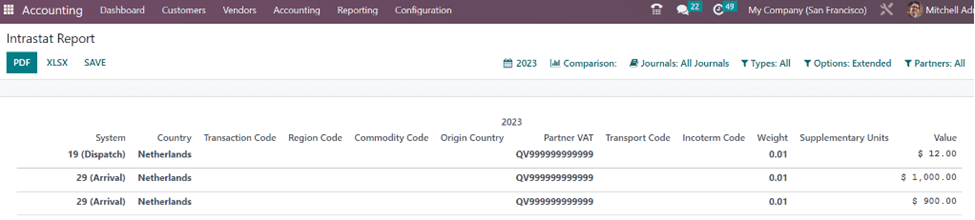

The ’Intrastat Reporting’ feature in Odoo enables the users to track the details regarding the movement of goods such as the System or process involved, Country, Transaction Code, Region Code, Commodity Code, Origin Country, Partner VAT, Transport Code, Incoterm Code, Weight, Supplementary Units and Value. The details such as VAT and Country are prespecified in the contact details of the partner.

Accounting Application => Reporting Menu => Audit Reports section => Intrastat Report

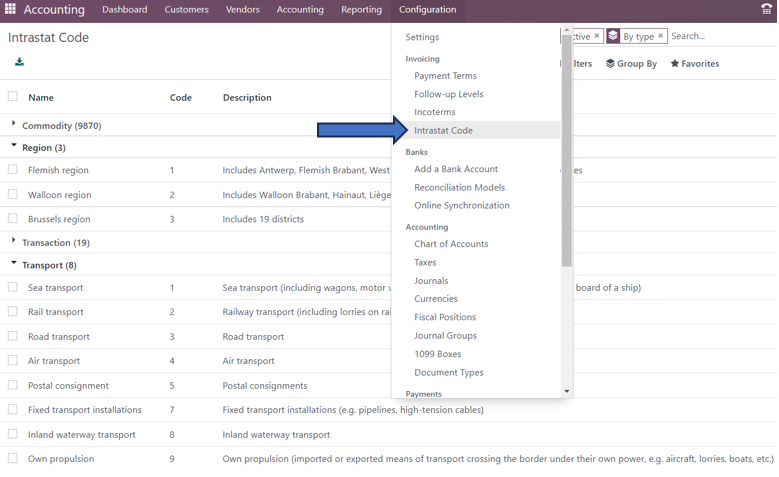

If we want to view all the codes used for such transactions between the EU member countries, just go to the ‘Configuration’ menu to select the ‘Intrastat Code’ option in the ‘Invoicing’ section.

The page displays the Name, Code, Description, Country, and Supplementary Unit.

Intrastat plays a crucial role in the functioning of the EU single market by providing valuable insights into the trade of goods between member states. It helps promote transparency and efficiency in cross-border trade, while also assisting in the development and evaluation of trade policies within the EU. It is inevitable to manage Intrastat and therefore Infintor Solutions, your trusted Odoo ERP Partner ensures that all global policies can be met through our solutions.