Accounting Reports in Odoo

Odoo is a comprehensive business management software that provides a wide range of reporting tools to help businesses monitor and analyze their operations. Some of the main reports available in accounting include financial statements such as Balance Sheet, Profit & Loss, Cash Flow Statement, Trial balance, General Ledger, Aged Payable, Aged Receivable, Tax Report, and more.It is possible to add annotations to every report before printing them. Additionally, you can export reports to Excel for further analysis and drill down into reports to view specific details such as payments, invoices, and journal items. Moreover, you can also compare values across different time.

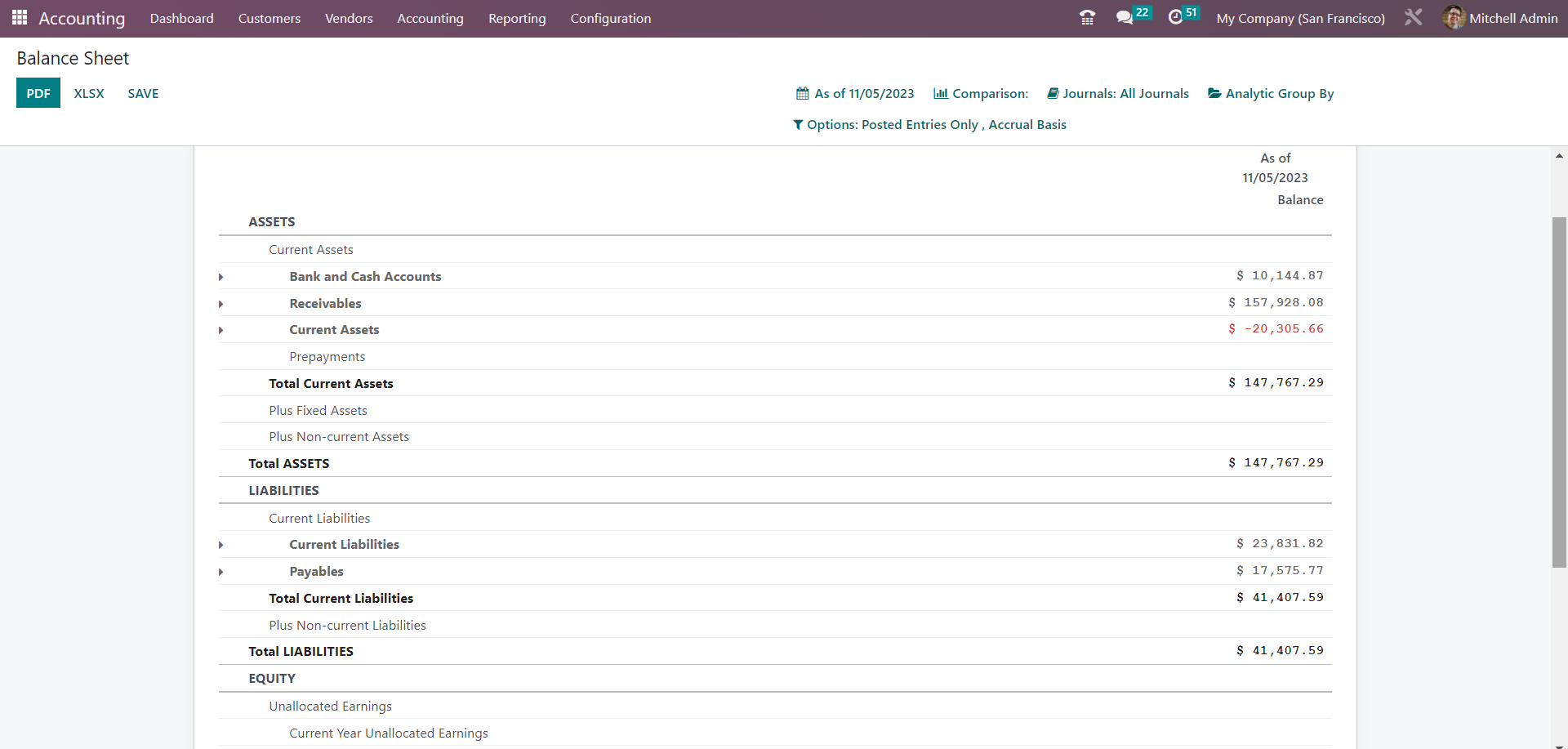

Balance Sheet

The Balance Sheet report is a financial statement that provides the company’s financial position by summarizing its assets, liabilities, and equity at a specific point in time.

To access the Balance Sheet report in Odoo follow these steps:

Reporting => Balance Sheet

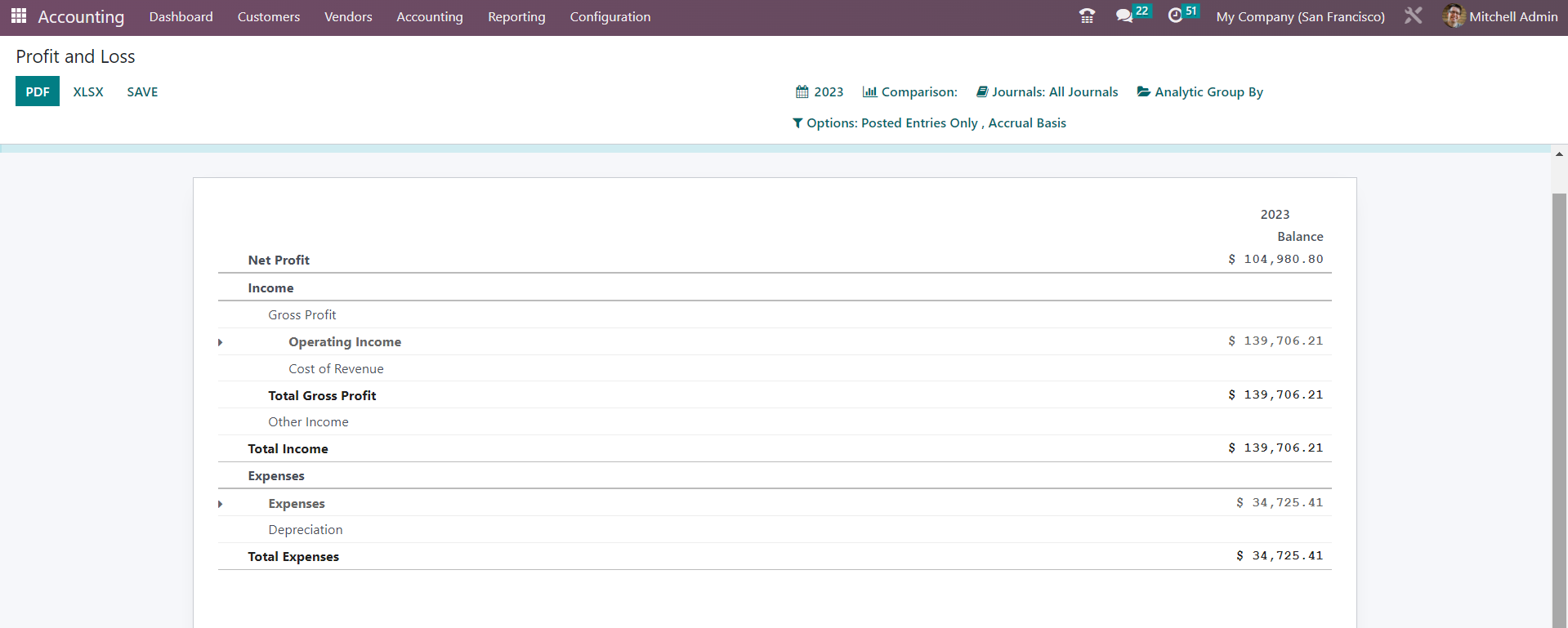

Profit and Loss

The Profit and Loss report is a financial statement that shows a company’s revenues, expenses, and net income or loss for a specific period. It helps businesses to evaluate their financial performance and make informed decisions.

Reporting => Profit and Loss

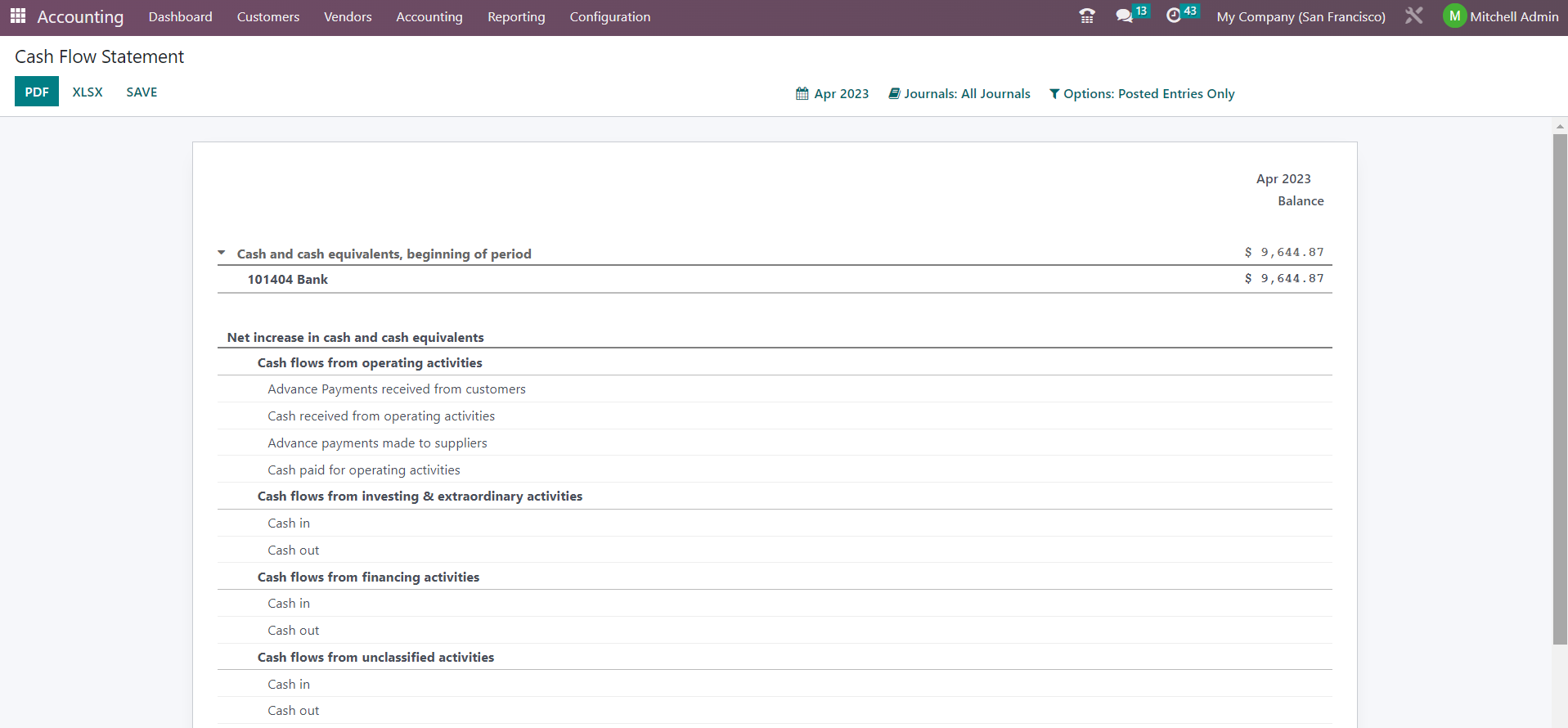

Cash Flow Statement

The Cash Flow Statement provides information about a company’s cash inflows and outflows over a specific period. It helps businesses to monitor their cash position and manage their cash flow effectively.

Reporting => Cash Flow Statement

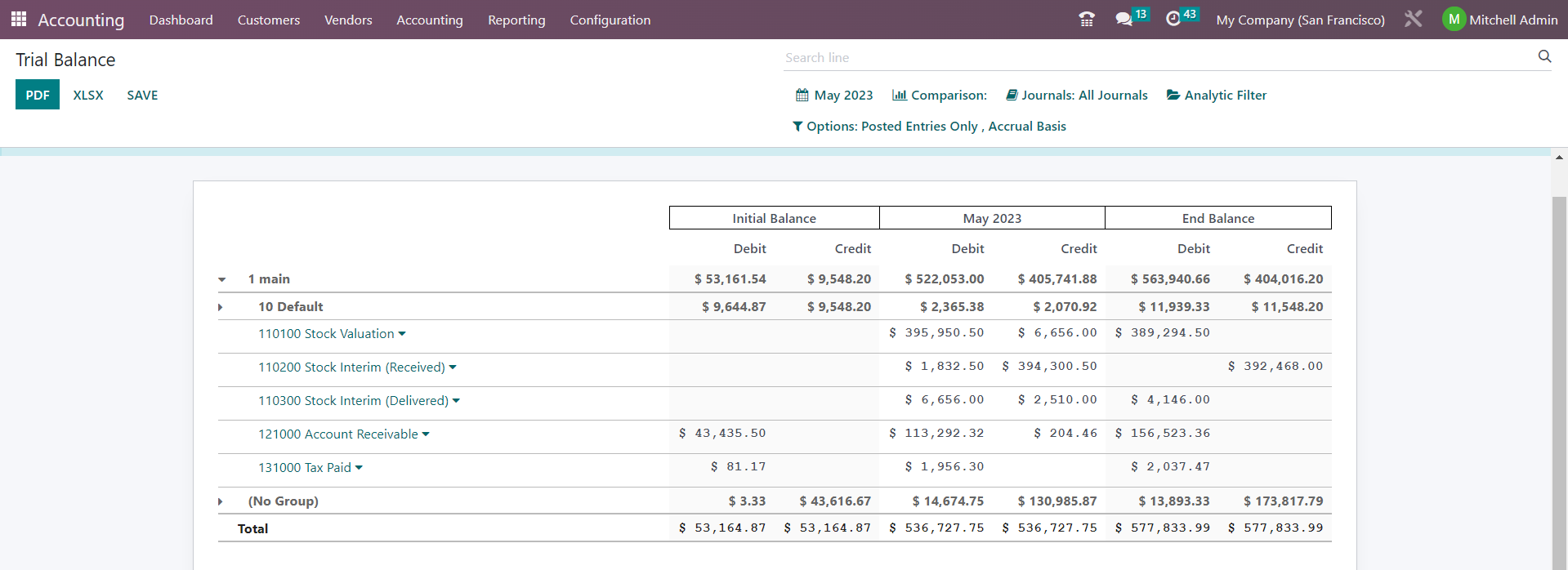

Trial Balance

The Trial Balance report is a financial statement that lists all the accounts in general Ledger along with their respective debit and credit balances. The purpose of the trial balance report is to ensure that the total debits and credits are equal, which is a fundamental principle of double-entry accounting.

Reporting =>Trial Balance

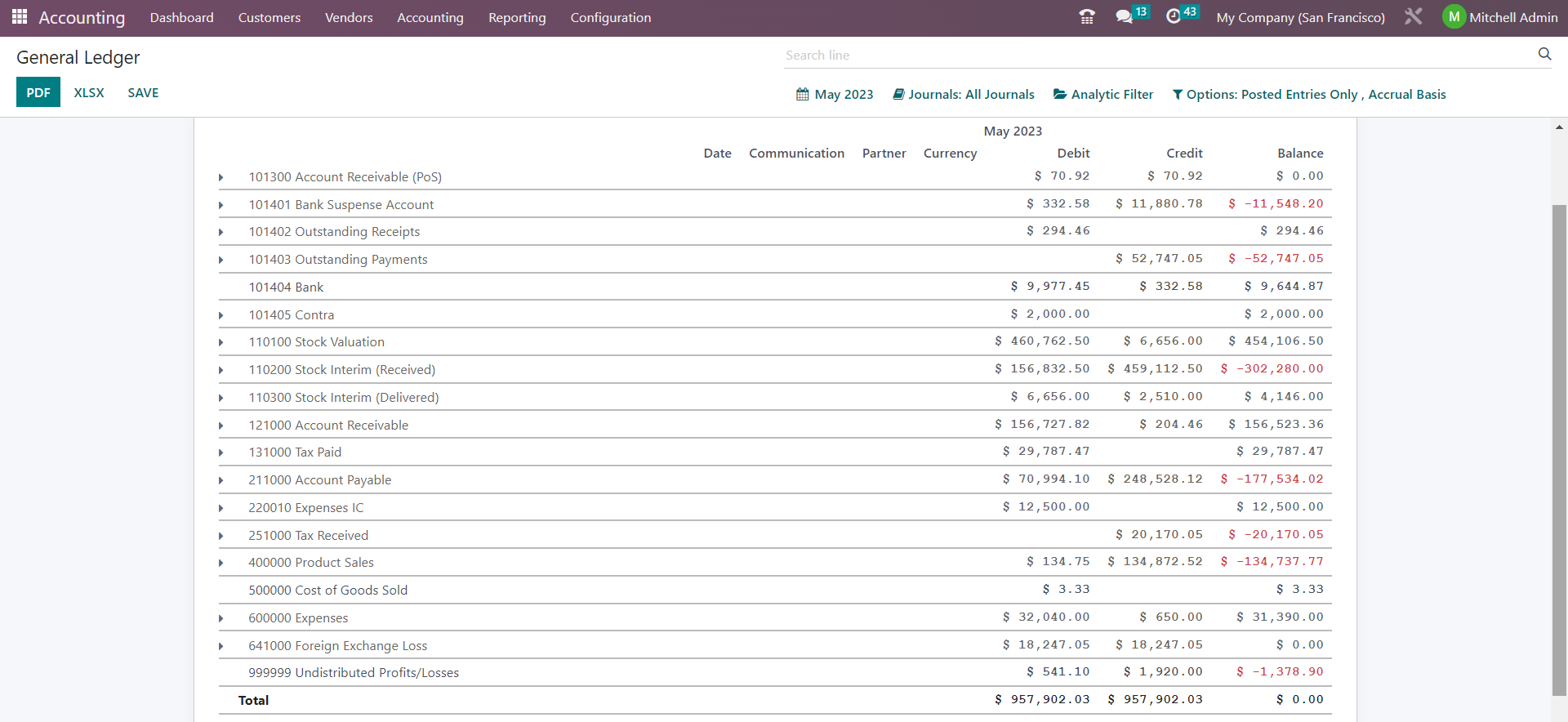

General Ledger

General Ledger contains a complete record of all financial transactions for a company. It provides a centralized location to manage all accounting transactions and allows businesses to track and analyze their financial activities.

Reporting => General Ledger

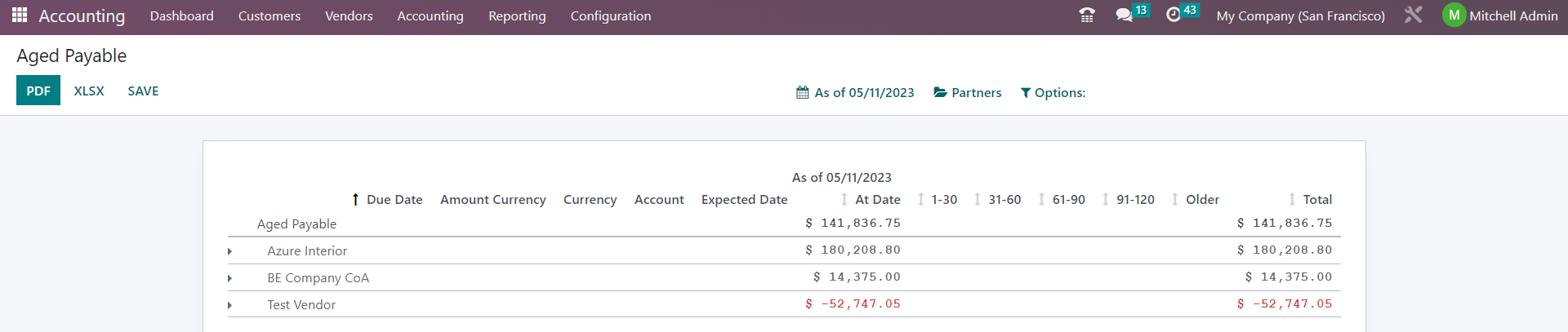

Aged Payable

Aged Payable report is a financial report that shows how much a company owes to its vendors or suppliers, based on the payment terms of their outstanding invoices. The report categorizes the outstanding invoices based on their due dates, allowing businesses to manage their accounts payable more effectively and make timely payments.

Reporting => Aged Payable

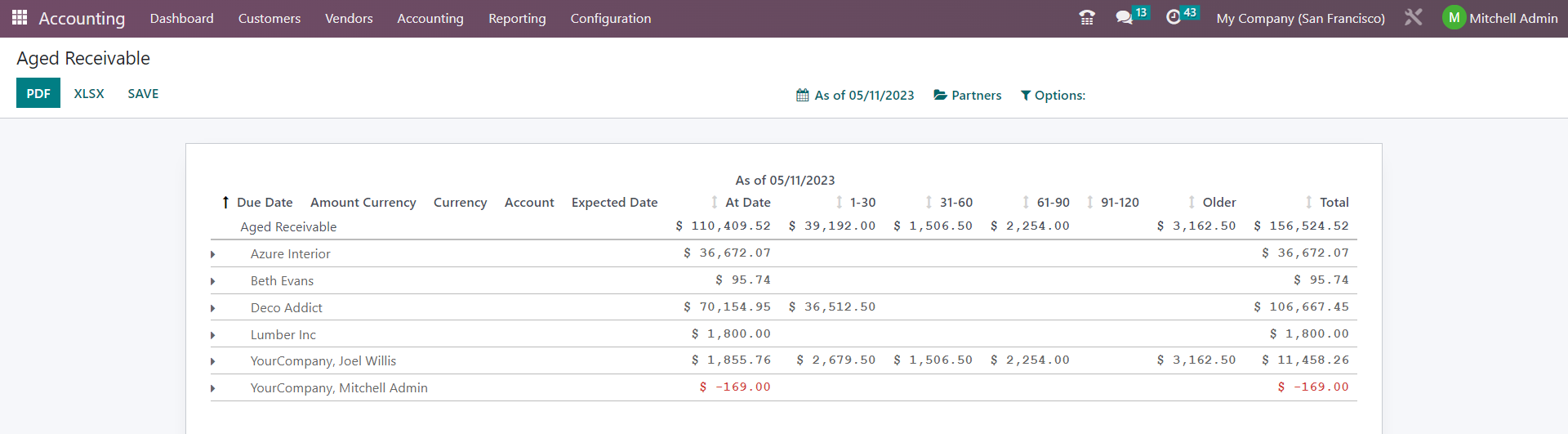

Aged Receivable

The Aged Receivable report is a financial report that shows how much a company is owed by its customers or clients, based on the payment terms of their outstanding invoices. The report categorizes the outstanding invoices based on their due dates, allowing businesses to manage their accounts receivable more effectively and follow up on unpaid invoices.

Reporting => Aged Receivable

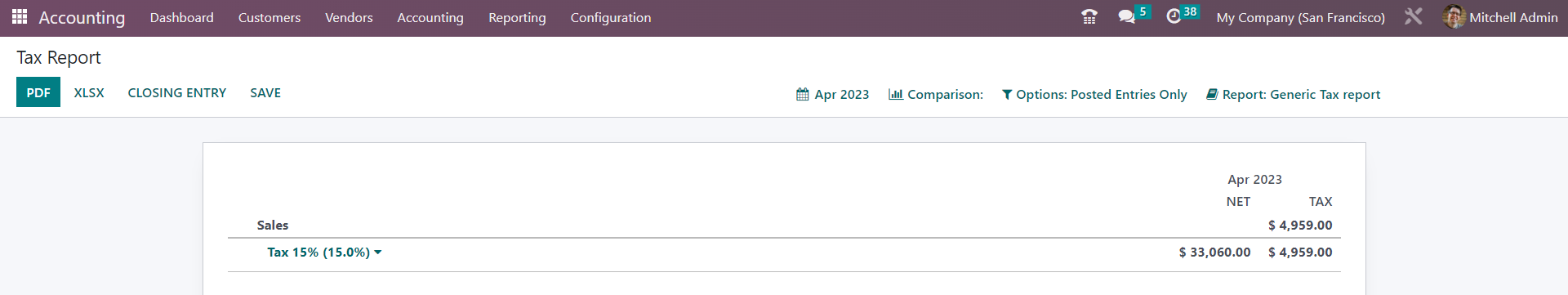

Tax Report

Tax Report shows a company’s tax liabilities and payments to tax authorities. The report provides a detailed breakdown of taxes by tax type, such as VAT, sales tax, or income tax, and includes information on tax collected from customers, tax paid to vendors, and tax owed to the tax authorities.

Reporting => Tax Report