How to Create and Manage Journal Entries in Odoo 16?

Journal entries are the primary way to record financial transactions such as sales, purchases, expenses, and other financial activities in an accounting system. Journal entries help ensure the accuracy of financial records. By maintaining a systematic record of transactions, businesses can track the flow of money and identify any discrepancies or errors. This promotes accountability and transparency in financial reporting. When auditors review a company’s financial records, they rely on accurately recorded journal entries to verify the integrity of the financial information. Properly recorded journal entries help ensure compliance with accounting standards and regulations. This is essential for legal and regulatory reasons, as well as for maintaining the trust of stakeholders, such as investors, creditors, and government authorities.

A key component of Odoo 16’s accounting and inventory integration is Journal Items. They represent items or services that a business buys or sells, acting as a middleman between financial transactions and inventory management. The Odoo inventory module allows for the creation and management of objects as well as the classification and specification of attributes like cost, tax rates, and measurement units.

Sales and purchases align with inventory adjustments and financial statements thanks to the synchronization of items and journal entries. Items that facilitate appropriate inventory valuation and analysis help accurate financial reporting and well-informed business decisions.

Creating a Journal Entry

A journal entry for a transaction can be made in a journal. A proper journal entry contains the accounting date, the amount to be debited and credited, the reference details, and a description of the transactions. Odoo’s Double Entry Bookkeeping System requires a minimum of one debit and one credit line. There must be an equal amount of credit and debit in a journal entry. The individual lines that comprise a journal entry are called journal items. You can access the Journal Entries platform from the module’s Accounting menu.

Accounting Application => Accounting menu => Journal Entries

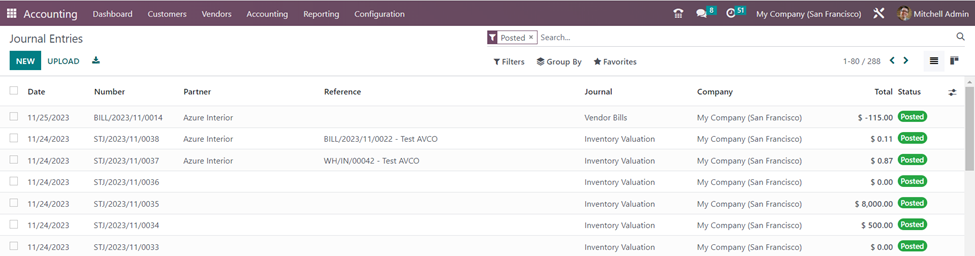

The list view displays the Date, Number, Partner, Reference, Journal, Company, Total, and Status information for each journal entry. To begin adding a new journal entry to a specific journal, click the ‘New’ button.

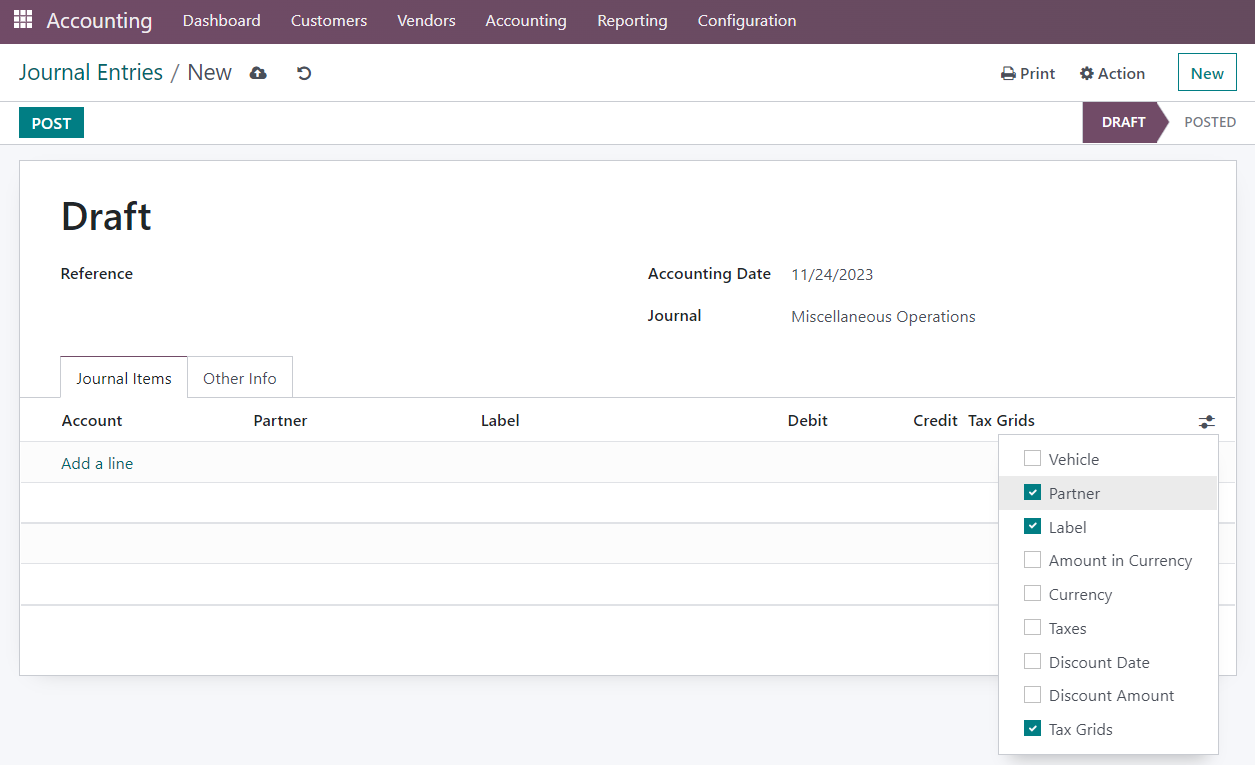

You can cite any sources that are pertinent to this journal post by using the Reference section. The Accounting Date of the entry will be shown in the corresponding field. To add this entry to your journal, select a suitable journal from the list of available journals. Using the ‘Add a Line’ button located in the ‘Journal Items’ tab, you can add journal entries by providing details like Account, Partner, Label, Analytic, Debit, Credit, and TaxCloud on this page. Other details such as Vehicle, Amount in Currency, Currency, Taxes, Discount Date, and Discount Amount can also be entered by selecting the required fields in the additional options as shown in the screenshot above.

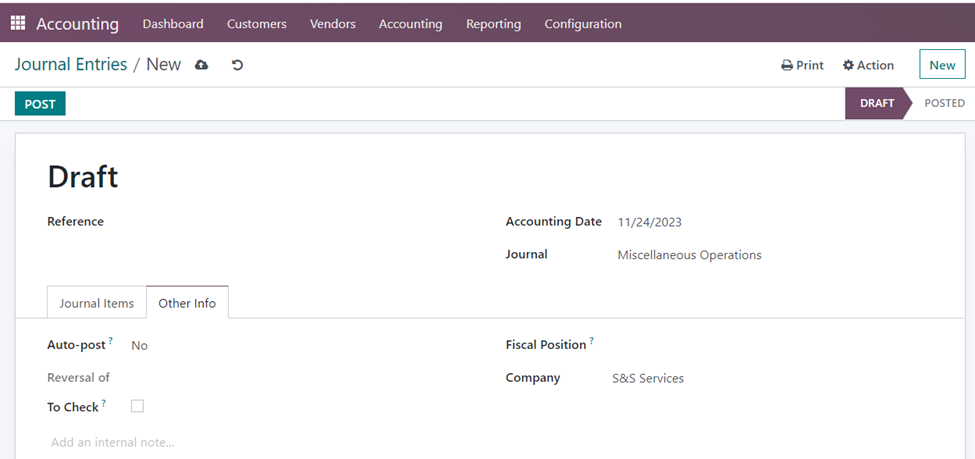

Under the ‘Other Info’ tab, you have the option to ‘Auto-post’ which will cause the item to be posted automatically on the applicable accounting date. If you feel that the entry has to be verified twice, you can activate the ‘To Check’ field. After indicating the Fiscal Position and Company, click the ‘Post’ button to post the entry in the relevant journal.

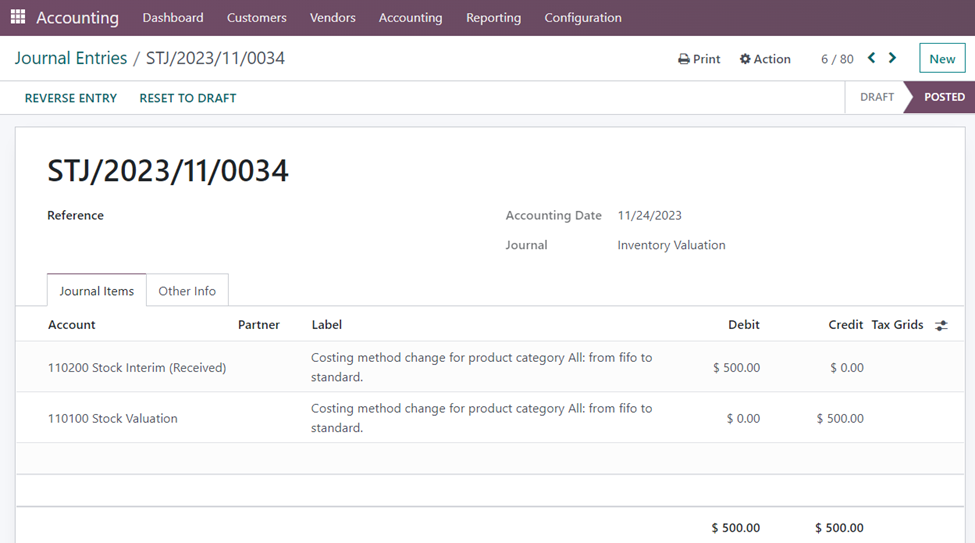

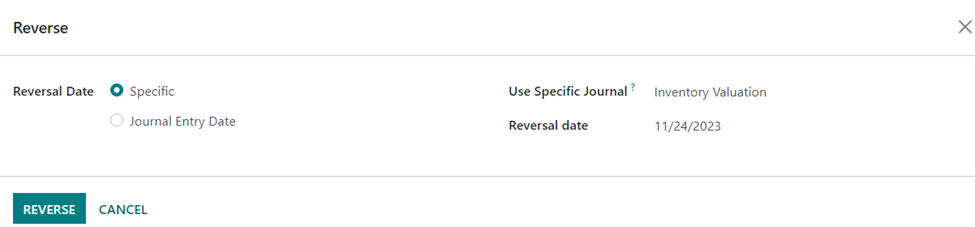

Reversing a Journal Entry

In some cases, transactions may be recorded in one accounting period for practical reasons, but the economic impact occurs in a subsequent period. Reversing entries helps align the financial records with the economic reality, preventing distortions in financial reporting. In accrual accounting, certain transactions are recorded before the cash is received or paid. For example, an accrual might be made for expenses that are incurred but not yet paid. Reversing entries helps avoid double-counting these items in the following accounting period when the actual payment or receipt occurs.

The ‘Reverse Entry’ button allows you to instantly undo a published journal article. There is a pop-up window where you may enter the Reversal Date and Specific Journal. After that, select the ‘Reverse’ option.

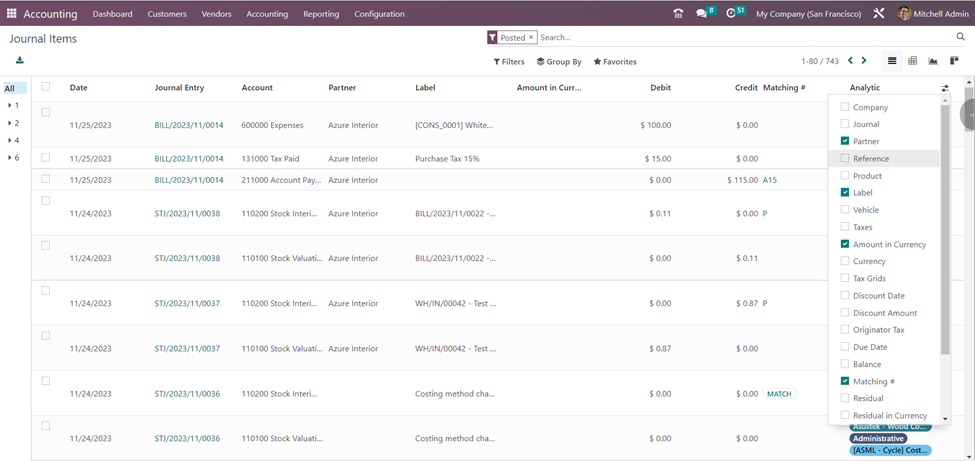

Journal Items in Odoo 16 Accounting

All the journal items entered in the system can be viewed by selecting the ‘Journal Items’ option in the Accounting Application.

Accounting Application => Accounting menu => Journal Items

The list view of the Journal Items shows details such as Date, Journal Entry, Account, Partner, Label, Amount in Currency, Debit, Credit, Matching or not, and Analytic Account. If you wish to view more details, you can select the additional columns that need to be viewed such as Company, Journal, Reference, Product, Vehicle, Taxes, Currency, Tax Grids, Discount Date, Discount Amount, Originator Tax, Due Date, Balance, Residual and Residual in Currency.

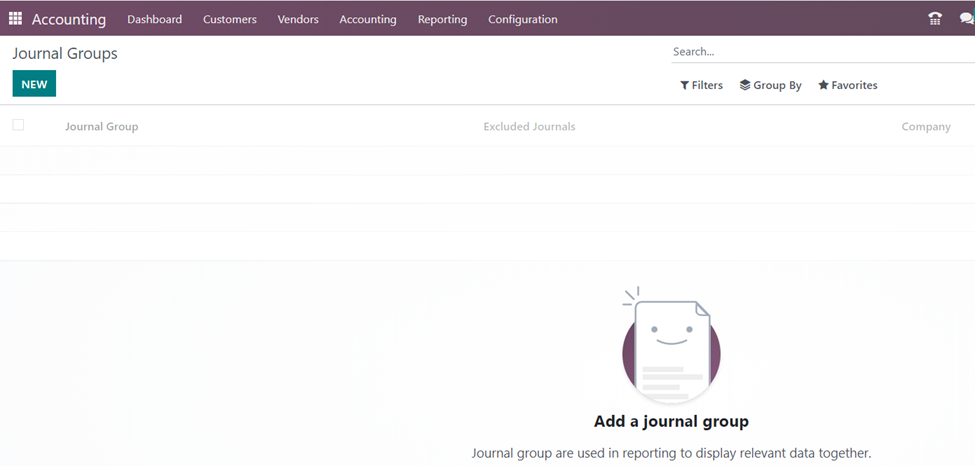

Journal Groups in Accounting Application

With the ‘Journal Groups’ option under Configuration, you may create distinct groups for the journals.

Accounting Application => Configuration menu => Accounting section => Journal Groups => New

Enter a name for your specific journal group. In the ‘Excluded Journals’ section, you can enter the journal IDs that you wish to have removed from this group. The name of the Company will be automatically entered into the relevant box.

To effectively create and manage journal entries, it’s important to follow accounting principles and guidelines. The Odoo 16 accounting software solution can automate many aspects of the journal entry process, making it more efficient and reducing the likelihood of errors. It is nothing complex to manage your financial transactions with the solutions provided by Infintor Solutions. As a partner in your success, we prioritize understanding your unique challenges and goals. Our comprehensive approach involves crafting solutions that are not only technically proficient but also strategically aligned with your business vision.