How to do Tax Mapping Using Fiscal Positions in Odoo 17?

Different countries and regions have distinct tax laws and regulations. Tax mapping helps businesses understand and comply with the specific tax requirements in each jurisdiction where they operate. It ensures that the company is meeting its tax obligations and avoiding penalties for non-compliance. For multinational corporations, tax mapping is especially important due to the complexity of dealing with multiple tax jurisdictions. It helps in identifying the most tax-efficient structures for cross-border transactions, transfer pricing, and other international business activities. It also allows businesses to optimize their tax positions by strategically organizing financial transactions. By understanding the fiscal impact of various activities, companies can structure their operations in a way that minimizes tax liabilities and maximizes available tax incentives.

The Odoo 17 ERP Suite provides the facility to manage multiple taxes using Fiscal positions in its Accounting Module. Managing a variety of tax types is made easier by the fiscal Position. Every nation has a different tax for customers, which can be established utilizing the fiscal position’s localization features. You can configure distinct rules in Odoo 17 to generate taxes specific to a given country. Before creating a fiscal position, the user must install the necessary localization function from the Odoo 17 Apps. We can see the localization record based on several countries once we choose the Accounting option under the CATEGORIES section.

This article will provide you with a step-by-step guide on configuring fiscal positions. Before creating a fiscal position, we have to create taxes for goods and services for that particular country.

Creating Taxes in Odoo 17

To configure the new tax in the Odoo system, follow the path below:

Accounting Application => Configuration Menu => Accounting section => Taxes => New

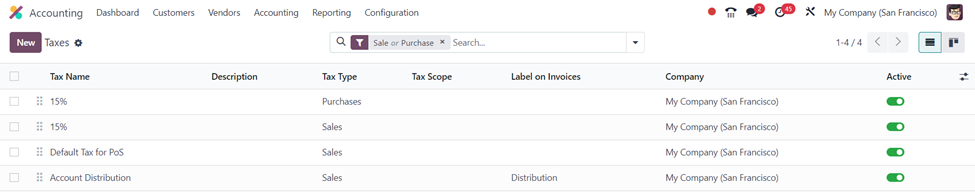

In the ‘Taxes’ window, details such as Tax name, Description, Tax type, Tax scope, Label on invoices, Company, Country, and status of the preconfigured taxes are displayed. Select the ‘New’ option in the window to create a new tax.

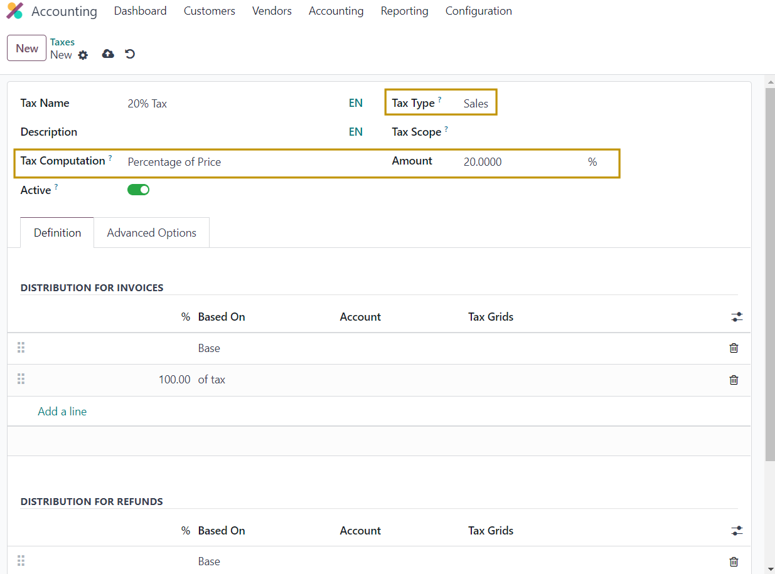

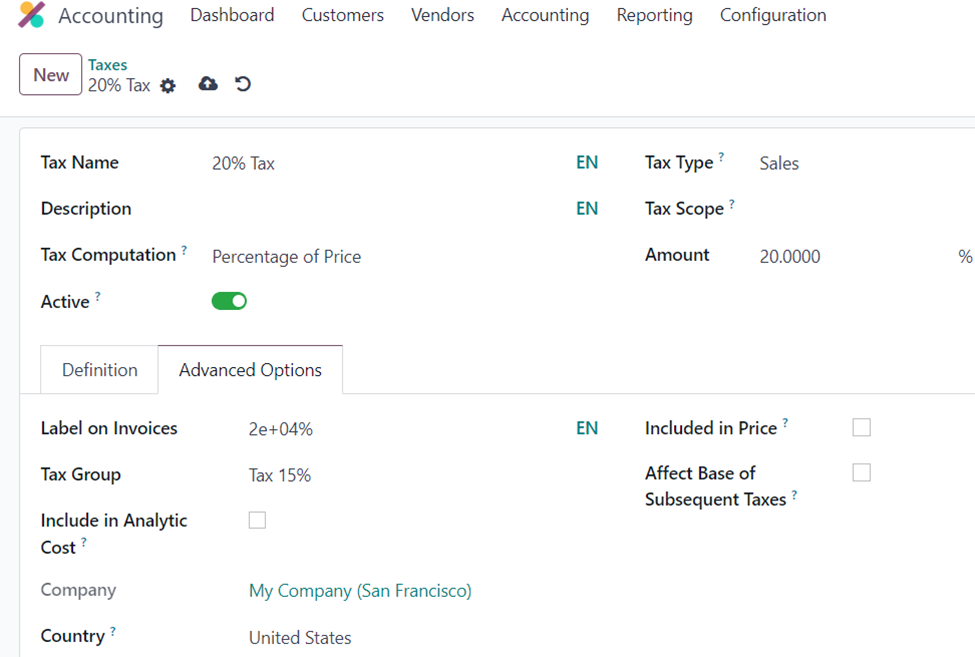

In the new tax form, we can enter the tax details such as Tax name, description, Tax computation, Tax type, Tax scope, Amount, Active, and other details regarding distribution for invoices and refunds in the ‘Definition’ tab. In the ‘Advanced Options’ tab, we can enter the label on invoices, tax group, company, country, and so on.

In the ‘Tax Computation’ field, we have the option to select the method of tax computation such as Group of Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, and Python Code. As we have selected the Percentage of Price as the tax computation method in the example shown above, we have to enter the percentage of the total amount to be considered for the tax in the ‘Amount’ field. Since the tax is 20% tax, we can enter 20 in the Amount field. We can select Sales, Purchase, or None in the Tax Type.

It is in the ‘Advanced Options’ tab that we have to set the company and country in which the tax is applicable.

After entering all the required information in the tax form, we can save the newly created tax. Now that we have configured a new tax in the Odoo system. This tax can be added in the fiscal position. Let us see how!

Creating Fiscal Positions in Odoo 17

The term ‘fiscal position’ refers to the financial condition of a government, including its revenue, expenditures, and overall budgetary situation. A sound fiscal position is essential for maintaining economic stability. Governments with responsible fiscal policies can better manage economic downturns, as they have the flexibility to implement counter-cyclical measures such as increased spending or tax cuts.

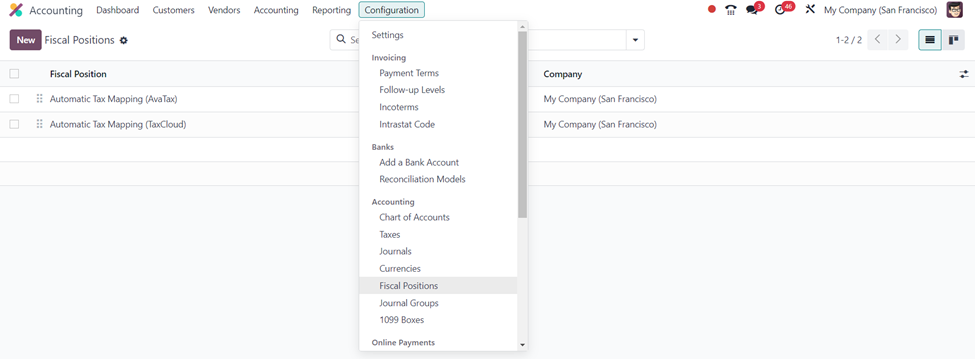

To create a fiscal position in Odoo 17, follow the path below:

Accounting Application => Configuration Menu => Accounting Section => Fiscal Positions => New

After heading to the ‘Fiscal Position’ window, let us select the ‘New’ option to define the new fiscal position.

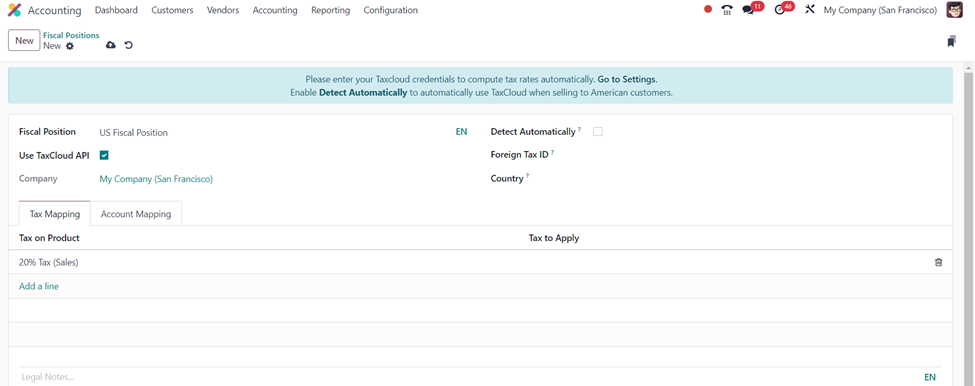

In the Fiscal position form, enter the fiscal position name, and select the ‘Use TaxCloud API’ option to compute tax rates automatically. We are required to select the ‘Detect Automatically’ option to enable using TaxCloud when selling to American customers. In the ‘Tax Mapping’ tab of the form, let us add the 20% Tax which we have created earlier in this blog using the ‘Add a line’ option. Similarly, we can also add the Account on the Product and the Account to Use in the ‘Account Mapping’ tab. After entering the necessary details, ‘Save’ the created fiscal position.

Creating Customer Invoice in Odoo 17 Accounting Module

We can create a new invoice to specify the Fiscal Position in a customer invoice.

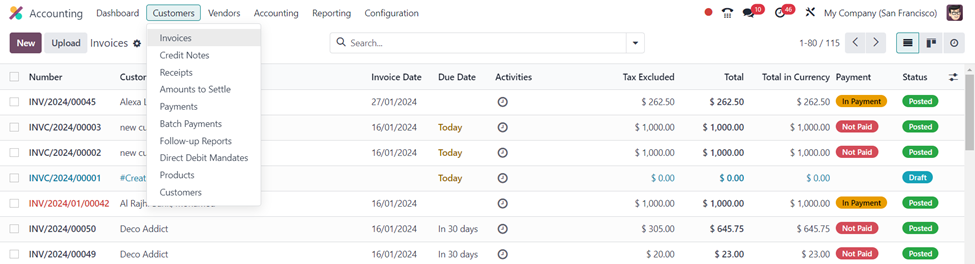

Accounting Application => Customers Menu => Invoices => New

The ‘Invoices’ window shows all the customer invoices created in the Odoo system so far. Click on the ‘New’ button in the window to create a new customer invoice in the Odoo Accounting Application.

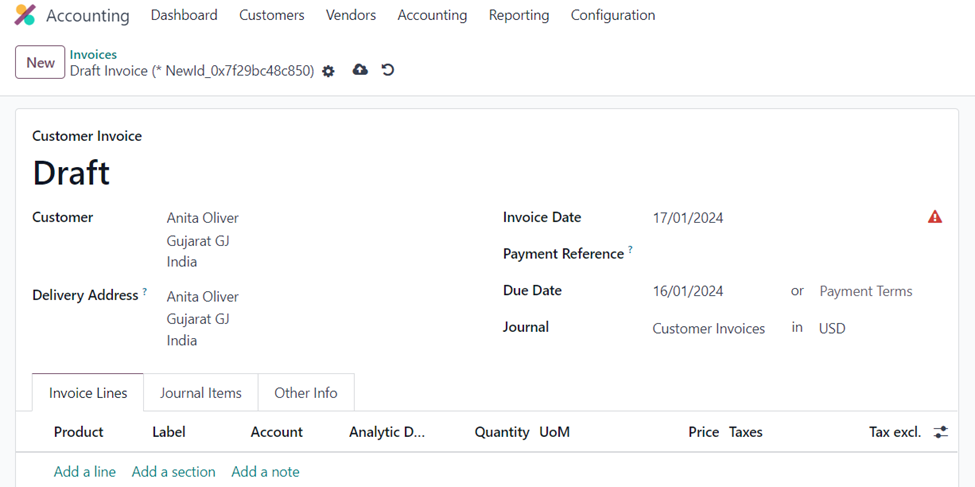

We can select the customer and automatically the delivery address and other details are entered which is preconfigured in the Odoo software.

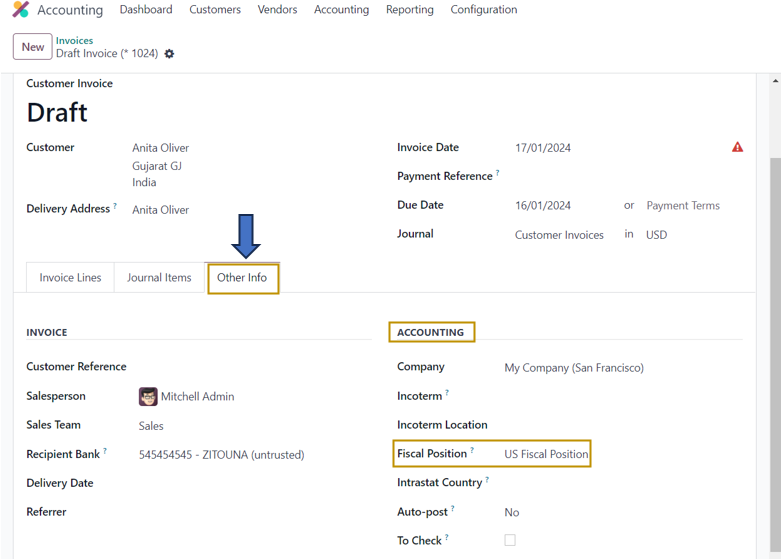

Now, to specify the fiscal position, navigate to the ‘Other Info’ tab of the customer invoice. There we will find the ‘Fiscal Position’ field in the ‘Accounting’ section in which we can select the required fiscal position configured in the system from the dropdown.

In the ‘Invoice Lines’ tab of the invoice, we can add the required products and their quantities. After that, we can confirm the draft customer invoice created and proceed with further steps as usual.

Creating Taxes and Fiscal Positions is easy using Odoo ERP software. The Odoo software enables users to configure different tax rates according to each fiscal position. Managing the accounting processes of your business can be made simple by using the Odoo ERP suite.