Internal Cash Transfer in Odoo 16 Accounting module

Internal cash transfer refers to the movement of funds or money within an organization from one department, division, or account to another. It involves the transfer of funds from one internal source to another within the same company. Companies with centralized treasury functions may transfer funds between accounts to optimize their cash flow, maximize investment returns, or pay off debt. Internal cash transfers are typically documented and tracked to ensure transparency and compliance with financial regulations and accounting standards.

Odoo 16 provides the best accounting platform where we can create bank accounts, transfer cash, record journal entries, and create and reconcile bank statements. With Odoo 16 Accounting module, you will never need to worry about your financial operations.

In this blog, we are going to the Accounting module to see how to add a bank account, make internal transfers, create bank statements, and do bank reconciliation.

Configuring a Bank Account in Odoo

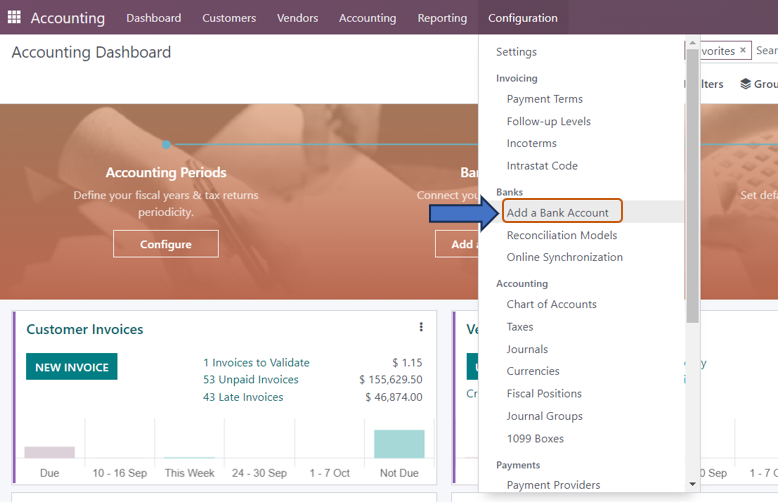

Accounting module => Configuration menu => Banks section => Add a Bank Account

When you select the option, a pop-up window appears where you can search for the Bank in which the account to be added exists. We can select from the available banks either by scrolling down or searching for the particular bank in the search bar. Once you select the required bank, click on the ‘Connect’ option. If you don’t find your bank, you can select the ‘Create it’ option at the bottom-right portion of the pop-up window.

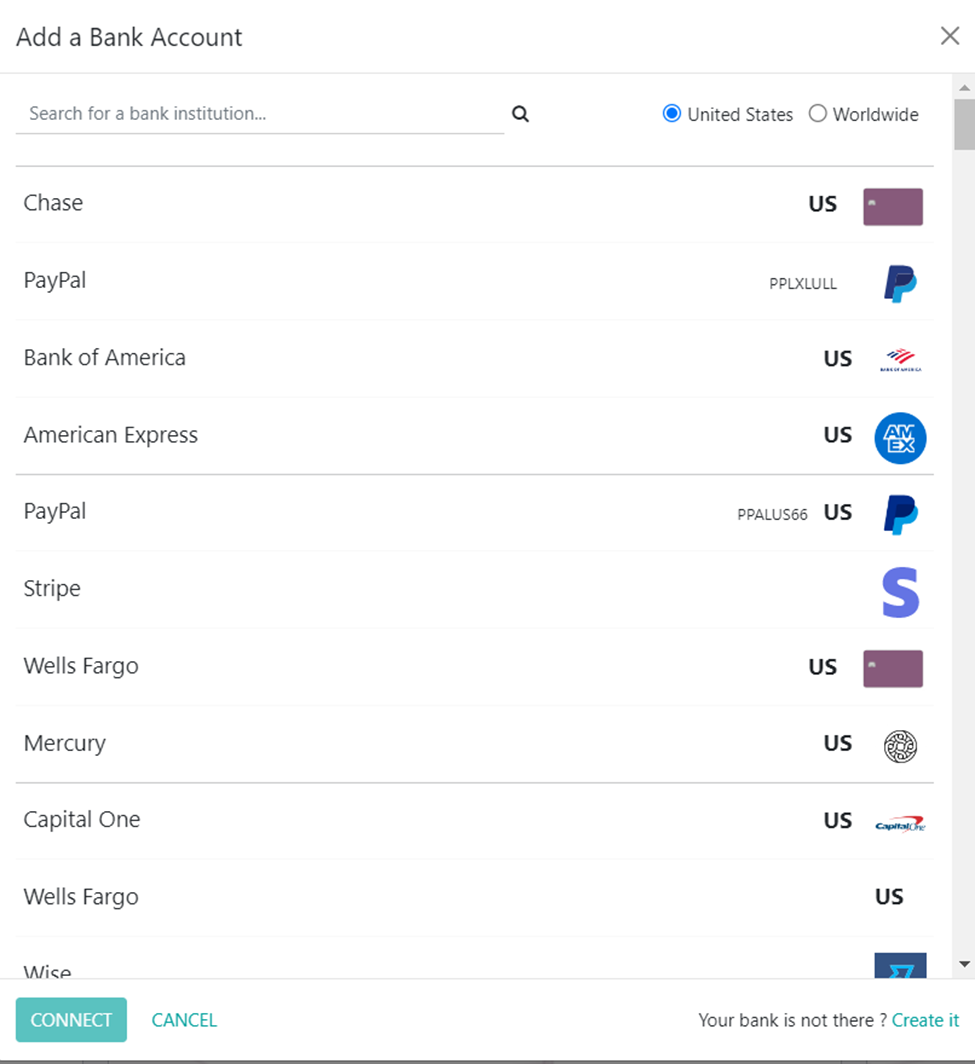

On selecting the ‘Create it’ option, another pop-up window appears where you are required to enter the Account Number, Bank, Bank Identifier Code, and Journal. If you don’t enter any journal in the ‘Journal’ field, a new journal for that bank account is created. After entering all the details, click on the ‘Create’ option.

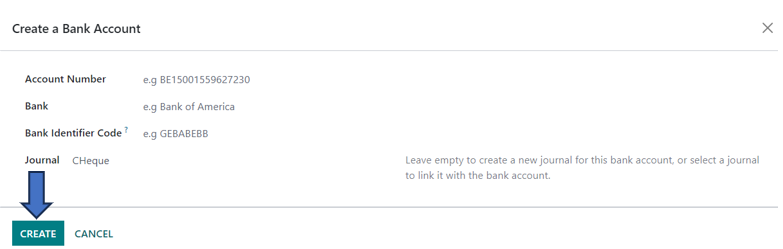

Now that the Bank account is created and configured in the Odoo database.

Internal Transfer in Odoo

Suppose, we want to transfer an amount from one bank account to the other account of that same company.

Here, we are going to transfer $10000 from ‘Bank’ to ‘Bank 2’. The process starts with an internal transfer of $10,000 from the source bank account (here, ‘Bank’) which can be done by clicking on the three dots in the ‘Bank’ journal and selecting the ‘Internal Transfers’ option.

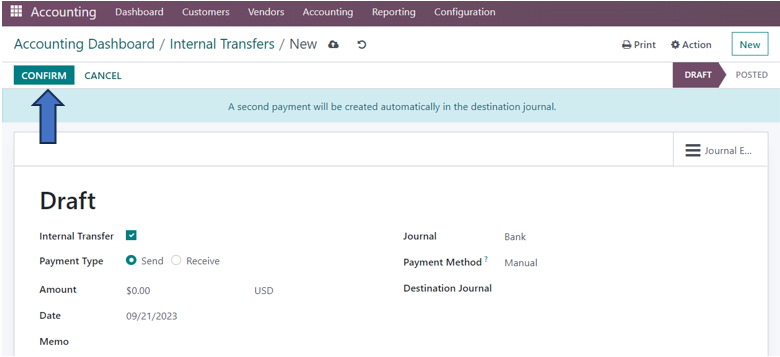

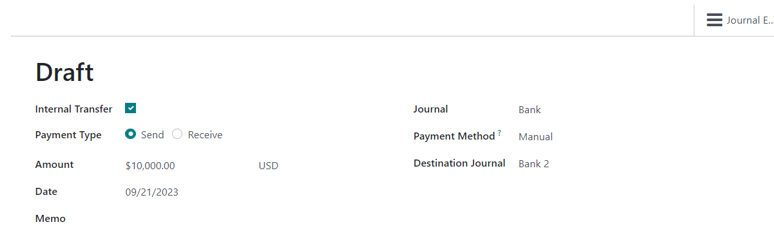

Then, we can go to the Internal Transfers page where you need to select the ‘New’ option to create a new internal transfer. A draft of the new internal transfer is created along with the option ‘Internal Transfer’ automatically selected and the ‘Date’ already entered. Here, we can set the Payment Type as ‘Send’ because we are going to send $10000 from the account Bank. Enter the required amount (here, $10000) to be transferred in the Amount field. We can enter other details such as Journal, Payment method, Destination journal, and Memo. The Destination journal here is Bank 2 where the cash is transferred to.

Now, the draft looks like the screenshot below.

After entering the details, click on the ‘Confirm’ option.

On going back to the dashboard and observing the Bank journal, you can notice the change in the amount of Outstanding Payments from -45,588.31 to -55,588.31 which is due to the transfer of $10000 from the Bank account.

Similarly, you can notice the amount of $10000 added to the Outstanding Payments of the account Bank 2. In this case, the source account is ‘Bank’ and the destination account is ‘Bank 2’.

The next step is to clear the outstanding payments through Bank reconciliation. For this, we need to create Bank statements.

Bank Reconciliation

Firstly, we can create a bank statement for the source account (here, Bank). For that, go to the source account journal and click on the ‘Reconcile’ option in the Accounting dashboard.

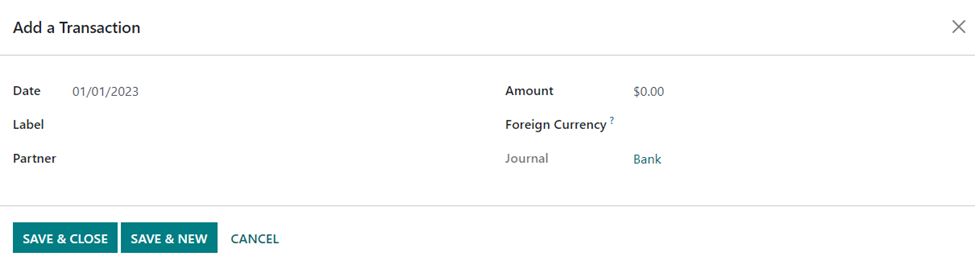

This is the Reconciliation page of that bank account. Click on the ‘New’ button to create a new bank statement for the internal transfer. The ‘Add a Transaction’ window appears where we are required to enter the Date, Label, Partner, Amount, Foreign Currency (optional), and Journal.

After entering the details, select the ‘Save and Close’ option at the bottom of the window.

The new transaction is added to the Reconciliation page.

After selecting the suitable counterpart of that transaction, click on the ‘Validate’ option. You can select the source account in the ‘Account’ field in the ‘Manual Operations’ tab. Here, we will select ‘Bank’ as the account in the Account field because ‘Bank’ is the account from which the amount is transferred.

On validating the transfer, the reconciliation is completed. Now, when you go back to the journal of the source account ‘Bank’ in the Accounting dashboard, you can no longer see the Outstanding Payments of the transferred amount -$10000 as it is reconciled. You will also notice that $ 10,000 is decreased in the running balance of the source account.

The next step is to reconcile the transferred amount in the destination account ‘Bank 2’. Follow the same procedure for the reconciliation of the source account as illustrated before by going to the destination account journal, creating a new transaction, and selecting and validating the counterpart source account ‘Bank’.

The journal here is Bank 2 as it is a transaction associated with the destination account. After entering the details, select the ‘Save and Close’ option at the bottom of the window. You can see the added transaction on the Reconciliation page.

After validation, the transaction is reconciled and the outstanding payments in the Bank 2 journal are cleared.

On going to the Accounting dashboard, the running balance in the Bank 2 journal is increased from $4,024 to $14,024 as $10000 is transferred to the account Bank 2.

This is how you can easily create and configure your Bank accounts and make internal transactions thus simplifying your financial operations. As an Official Odoo Partner, we ensure that all your financial transactions are recorded accurately and smoothly.