Reconciliation models in Odoo 16

Bank reconciliation is a critical financial process that helps ensure the accuracy and consistency of an organization’s financial records, particularly those related to cash transactions. The primary goal of bank reconciliation is to compare an entity’s internal financial records (such as the company’s general ledger) with the information provided by its bank statement. Discrepancies are then identified and resolved to ensure that the financial records are accurate and up-to-date.

In the context of bank reconciliation, various reconciliation models and techniques are employed to match and align the financial records maintained by a business with the information provided in the bank statement. Automated accounting software often facilitates the bank reconciliation process by streamlining the comparison of financial data between the company and the bank.

Let us see how the Odoo 16 Accounting Application can help businesses streamline their reconciliation process through different reconciliation models.

Types of Reconciliation Models

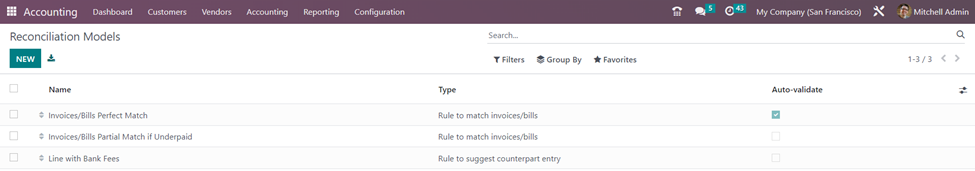

There are three types of Reconciliation models in Odoo 16: Generate Counterpart Entry, Suggest Counterpart Entry, and Match Invoices/Bills. We can navigate into each reconciliation model to understand the same.

Accounting Application =>Configuration menu => Bank section => Reconciliation Models

The page shows basic details of the configured reconciliation models in the system such as Name, Type, and Auto-validate or not. If you want to create a new reconciliation model, select the ‘New’ button. To get more details, select a reconciliation model.

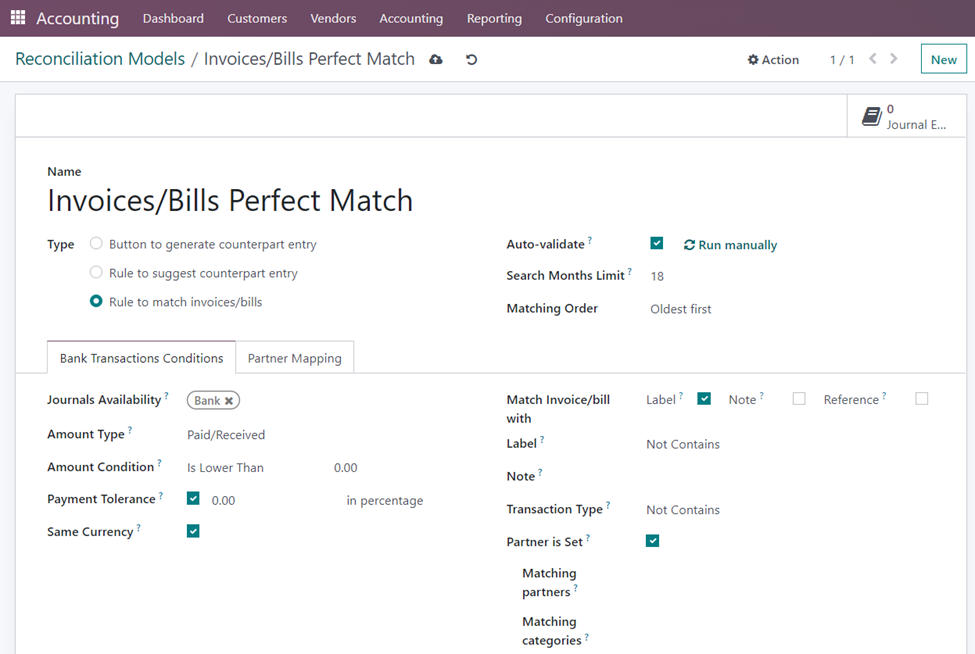

=> Rule to Match Invoices/ Bills

With this type, it is possible to select the appropriate vendor bill, and the customer invoice and payment match automatically. Later, to execute reconciliation per your rule, activate the ‘Auto-Validate’ option. In the ‘Search Months Limit’ section, enter the number of entries for your model from the previous month. There are two ways we can match the order: Oldest first and Newest first.

In the ‘Bank Transactions Conditions’ tab, we can add additional criteria to the reconciliation model. Within the ‘Journals Availability’ box, you can select a journal for the reconciliation model. Furthermore, indicating Paid/Received for the Amount Type guarantees that money is paid as well as received. With the ‘Amount Condition’ option, you may set any kind of condition for the amount.

By selecting 0 for ‘Payment Tolerance’, we obtain the precise difference between the invoice and the bill. Additionally, after the ‘Same Currency’ section is selected, the user can view the transaction in a comparable currency on a statement line. We can match invoices or bills with labels, notes, or references by selecting the required option in the check box. Only in cases where the label contains Match Regex, Contains, and Not Contains does a reconciliation model apply. Other than this, we can set Label, Note, Transaction Type, Matching Partner, and Matching Category to match the transaction based on the set criteria. The Matching Partner field enables the user to set a reconciliation model for a particular customer and the Matching Category allows us to set a reconciliation model for a particular group such as vendors, employees, prospects, and so on.

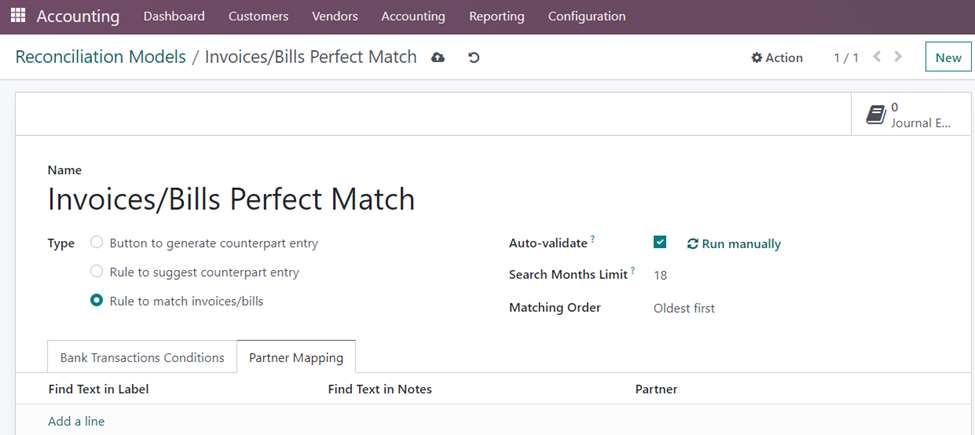

There is also another tab on the Reconciliation Model form namely, ‘Partner Mapping’. The tab allows us to find partners based on a text in Label and Notes. After entering the details, select the ‘Save’ option. If all these requirements are sufficiently satisfied, the system will validate the matching and transaction automatically.

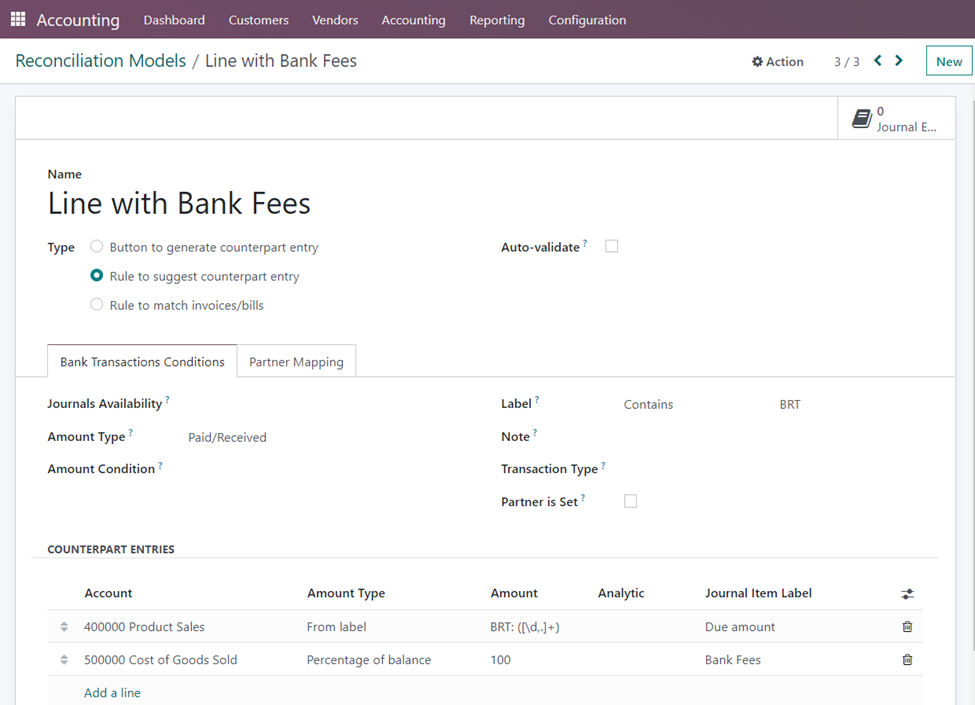

=> Rule to Suggest Counterpart Entry

Follow the same steps for the previously discussed reconciliation model. But in this case, Set the ‘Type’ as Rule to suggest counterpart entry. In this case, you will see a ‘Counterpart Entries’ section in the ‘Bank Transactions Conditions’ tab. In this section, users can access the financial expense accounts according to the label by adding and viewing Account, Amount Type, Amount, Analytic Account, and Journal Item Label.

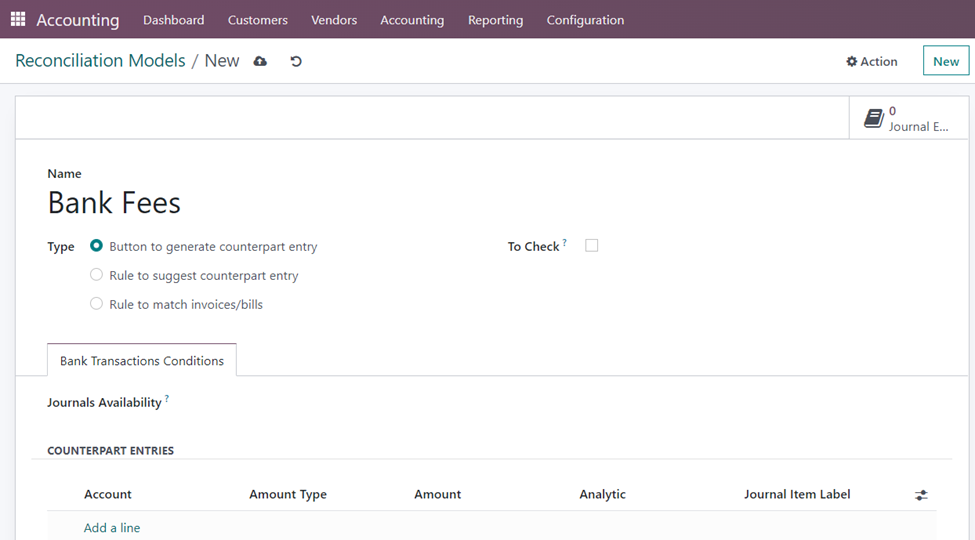

=> Button to Generate Counterpart Entry

Here, select the ‘Type’ as the Button to generate a counterpart entry. The reconciliation model specifies transactions that have been reconciled on one side but lack a corresponding entry on the other side. This functionality helps automate the process of creating the corresponding entry for a transaction, improving efficiency and accuracy in reconciliation. This feature is particularly useful in scenarios where a transaction affects multiple accounts or requires entries on both sides of the accounting equation.

Bank and cash are the two accessible journals for the reconciliation model in the ‘Journals Availability’ field. You can use the ‘Add a line’ option located beneath the Counterpart Entries section to apply for a new entry.

These are the types of Reconciliation models available in the Accounting module of Odoo 16. Hope this blog gets you up to the brink of insights on Reconciliation models. Check out our other blogs from Infintor Solutions to widen your Odoo functionalities.